Dua Residensi – Affordable Homes from RM250k

Strategically located at the southern coast of Penang Island, Dua Residensi is a project under Penang Affordable Housing Scheme (RMM) providing quality housing with an affordable price for Penangites.

Dua Residensi, a brainchild of the Penang State Government and Penang Development Corporation, located at Teluk Kumbar which is just a 10 minutes’ drive from Penang International Airport and about 15 minutes from the Second Penang Bridge.

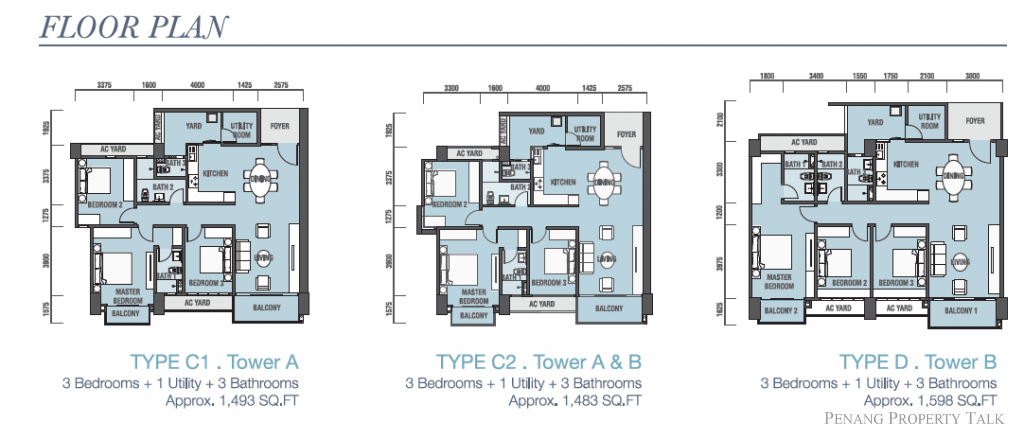

This development offers a total of 694 residential units with the size ranging from 850 sq ft to 1,000 sq ft. and priced from RM250,000. Featuring 2 blocks of residential units along with a 7-level multi-storey car park, this development also comprises a few units of 3-storey & 4-storey commercial shop offices.

Dua Residensi is now completed with CCC obtained. It is surrounded by lush greenery with a spectacular natural environment and stunning landscape, complemented with recreational area and panoramic viewing deck from residential tower.

For more details on Dua Residensi, please contact Penang Development Corporation at 04-6139999 and 04 -5050001. You may also register your interest below to receive a callback.

Register your interest here

PENANG DEVELOPMENT CORPORATION

Level 1 Tun Dr Lim Chong Eu Building, No. 1, Persiaran Mahsuri, Bandar Bayan Baru,

11909 Bayan Lepas, Penang.

Tel: 04 – 613 9999PDC SALES GALLERY BATU KAWAN

Pusat Rehat & Rawat, Lebuhraya Bandar Cassia, Batu Kawan,

14110 Simpang Ampat, SPS Pulau Pinang

Tel : 04 – 505 0001

PROJECT LOCATION