Three-quarters of residents happy with liveability, green efforts and freedom in Penang

Penang Institute today unveiled the results of its Happiness in Penang (HIP) Index and found that 76.5% of the 3,011 residents surveyed identified as happy.

The survey, which was conducted during October 2020 and May 2021, found 23.5% of the respondents are “not-yet-happy”, 13.7% are “narrowly happy” and 9.9% are unhappy.

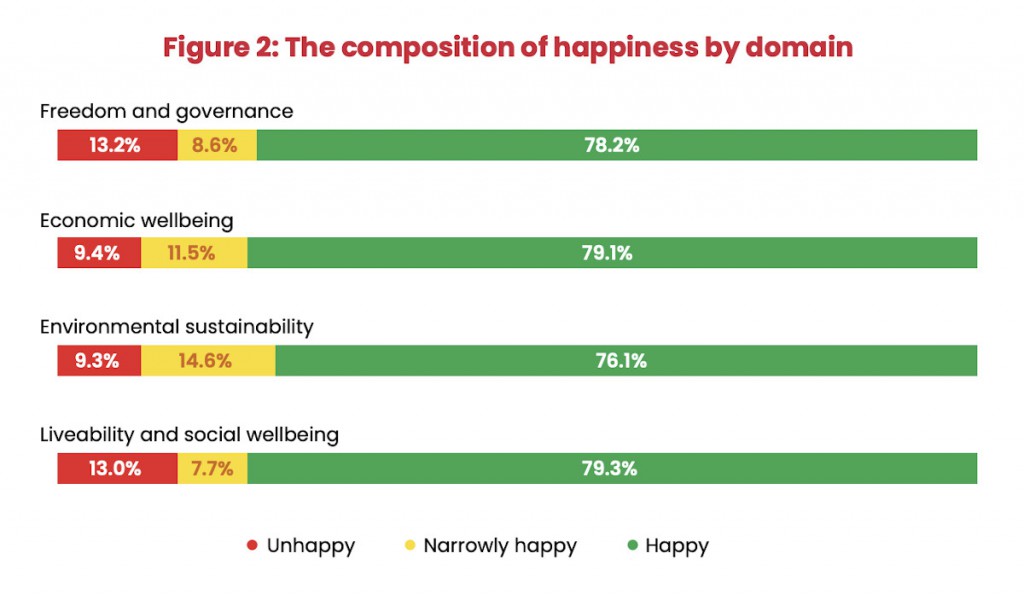

The survey also found that 78.2% of the respondents are happy with the freedom and governance in the state.

It found that 79.1% of respondents are happy with their economic wellbeing, 76.1% are happy with the environmental sustainability efforts taken by the state government and 79.3% are happy with the liveability and social wellbeing in Penang.

According to Penang Institute senior analyst Negin Vaghefi, statistically the 3,011 respondents are representative of Penang’s estimated 1.8 million population with a margin of error of about two percent.

Penang Institute Chief Operations Officer Ong Siou Woon said the HIP Index survey was conducted between October last year and May this year where about 1,400 respondents are online and the remaining are through face-to-face interviews.

“This survey was conducted using Bhutan’s Gross National Happiness Index (GNH) framework,” she said in a press conference revealing the results of the survey.

She said the HIP Index covered four domains, namely: freedom and governance, economic wellbeing, environmental sustainability and liveability and social wellbeing.

“According to the respondents, Penang is a very liveable city where most indicators under the domain of liveability and social wellbeing achieved a strong level of satisfaction,” she said.

“Although some respondents indicated that their state of life was better before the Covid-19 pandemic, more than half professed themselves to be in at least a good stage of life,” she added.

However, when it comes to freedom and governance, she said there was a neutral attitude with governance achieving the lowest level of satisfaction while a high percentage are satisfied with their religious, cultural and spiritual freedom.

“Satisfaction over financial security are at considerably lower levels although high satisfaction levels are seen for social and economic mobility and household expenditure,” she said.

Another senior analyst Yeong Pey Jung noted that a large number of the respondents do not have sufficient savings to last them a year if they were to lose their main source of income.

Meanwhile, Ong said the HIP Index survey is the first of its kind in the country and it will be used for comparison for future similar surveys to be carried out by Penang Institute.

“We will conduct this survey every two to three years so we will be preparing for a similar survey in the first half of next year,” Ong said.

She said the respondents of the survey are from all over Penang in which 54.3% are female and the remaining 45.7% are male.

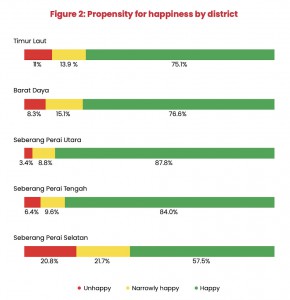

Out of the 3,011 respondents, 33.6% are from Northeast district on the island, 16.9% from the southwest district on the island, 15.3% from Seberang Perai Utara, 14.5% from Seberang Perai Tengah and 19.7% from Seberang Perai Selatan.

Out of the 3,011 respondents, 33.6% are from Northeast district on the island, 16.9% from the southwest district on the island, 15.3% from Seberang Perai Utara, 14.5% from Seberang Perai Tengah and 19.7% from Seberang Perai Selatan.

“Each domain and its respective indicators make different contributions to the overall happiness of Penangites, illustrating that happiness, satisfaction and sufficiency are subjective to each individual, and not clearly based on material factors alone,” she said.

Ong said the full report on the HIP Index will be published on the Penang Institute website next month.

Source: MalayMail.com