COVID-19 Crisis Measures & Opportunities (Part 2 of 2)

by Anders Ong

FOUR Measures That Can Be Taken During the Six Months Automatic Moratorium Period:

1. Increase Cash Reserve of Minimum 6 Months:

Preparing for the worst but hope for the best, because many businesses and companies may have to cut cost or start to do retrenchment. Cash reserve also serve as a mean for daily expenses such as foods and basic needs usage.

2. EPF Account 2 Withdrawals Under i-LESTARI:

EPF members may apply for the i-LESTARI Account 2 Withdrawal Schemes beginning April 2020. Remember to only withdraw if you are cash constraint due to loss of income from jobs or you wanted to reduce your existing debt burden.

3. Property Refinance:

Homeowners could take the opportunity to refinance their house in this market condition to cash out their home equity. Property owner who is in need of more cash to sustain their business or to safeguard their interest during this period could refinance their property for extra cash and to lower their existing mortgage interest rates without losing the ownership.

4. Existing Idle or Vacant Property:

If you have any properties which are not rented out yet, consider renting it out as soon as possible to increase monthly income and reduce debts. If you have any non-performing properties, consider to sell it off and restructure your future property plan before another property boom.

FIVE Opportunities That Arise During the Six Month Automatic Moratorium Period:

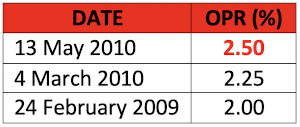

1. The Automatic Moratorium:

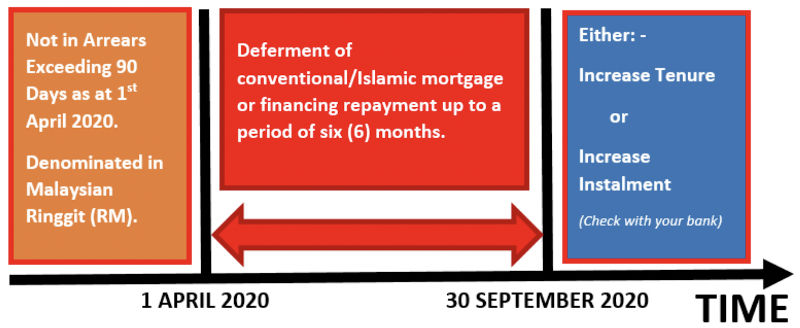

Should we take it or should we decline and make normal payment as usual? If we have job securities with fixed income and a lot of cash reserve, then it is of not much importance as we will still need to pay for the interest later on. But if we are commission-based or business owner and affected, then we should consider to take it as we will have extra cash reserve for monthly expenses, salary payment and company expenditure.

2. Six Months Period to Settle All High Interest Debt Commitment:

The extra money from the deferred payment of mortgages should have been use wisely. Use the extra cash available to pay off or reduce other debts which have higher interest rates such as Business Loan, Personal Loan and Credit Card installment.

3. Improve Your CCRIS & CTOS Report Score for Future Mortgage Applications:

Focus on settling any short term loans which had been in arrears before and reduce the numbers of bad debt under the record or debt consolidations.

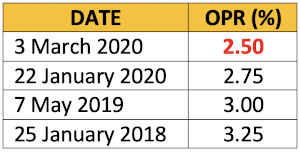

4. Refinance Property Again to Capitalize on The Low Interest:

If you had spotted any property which is worth to invest in the market downtrend, then refinance and invest. Some units are selling at a good price and the interest rates are low at this moment. But always invest with due diligence through real estate market studies of the prices, market segment and cash flow or hiring a professional estates agent.

5. Rental Income from Investment Property:

Any rental income received during this 6 Months Automatic Moratorium Period can be used to invest in other assets which can provide a higher percentage of return in the future. Make sure the other investment could reap a return of more than 5-6% to cover the mortgage interest rates.

Anders Ong – PEA, Property Investor, Writer, Speaker, Real Estate Coach, Property Market Analyst & Author of Back To Property Investment To Create Wealth

Twenty days into the movement control order (MCO), hardware shops, spare part shops (agriculture and industrial machinery), pet shops and shops that sell agriculture inputs have finally been allowed to open twice a week in Penang starting from yesterday.

Twenty days into the movement control order (MCO), hardware shops, spare part shops (agriculture and industrial machinery), pet shops and shops that sell agriculture inputs have finally been allowed to open twice a week in Penang starting from yesterday.