Does residential property hedge against inflation?

Real estate has traditionally been viewed as a safe investment asset with powerful inflation hedging capability compared to other assets such as stocks and bonds. However, the current pandemic-induced economic weakness is testing such a perception.

This is because the rampant house price growth since the coronavirus outbreak has put the residential property market at risk as when the housing bubble bursts, the likely ensuing panic sale will cause a drastic fall in prices, leading to the crash of the housing market, which can have detrimental effects on the entire economy.

Thus, it is imperative for real estate investors and would-be house buyers to understand the hedging abilities of Malaysian housing properties against inflation, so as to minimise their exposure to such risks in their portfolio.

Perhaps a simple descriptive statistic in nature focusing on correlation analysis of the annual data series of residential real estate returns and inflation rate can shed light on the asset’s inflation-hedging capability.

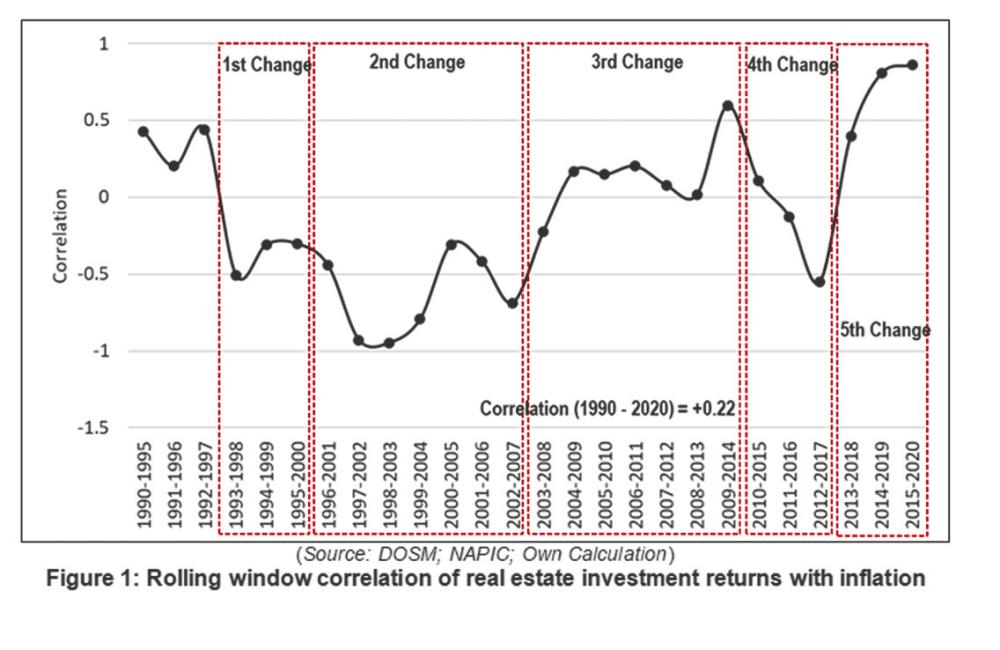

A perfect inflation hedge would have a correlation close to +1.00, indicating that both the tested variables increase proportionally at the same time; a correlation of -1.00 would indicate the exact opposite.

In general, a correlation of +0.22 is found throughout the period of 1990-2020. While this is rather low to qualify for a perfect inflation hedge, a positive correlation should indicate that returns gain from property investment will counterbalance, at least partially, a rise in inflation.

By applying the rolling window approach to investigate the behavioural changes in correlation throughout the studied period – where the time series are examined with a smaller five-year-interval perspective in order to control for the possible structural changes in the economy, and this period is then moved one year forward at a time – one can find that correlation is not only increasingly positive, but even reaches to its highest ever level at +0.86 around 2020 (chart).

This shows that while house prices have been moderating in recent years, a fall in inflation with a larger pace has, instead, led to an increasing synchronised trend between investment returns and inflation, making real estate a rather good hedge against inflation, albeit imperfect. From here, one can expect that real returns from real estate are not adversely affected by inflation.

Even if it does not perform as a complete hedge, with house prices growing much higher than inflation in the long run, coupled with its instant responses in the short run during inflationary pressure, housing could still be a valuable investment asset.

Having said that, the traits of real estate investments described above are powerful only if there is no oversupply in the market. This is because housing markets are more susceptible to supply excesses. Even if inflation is high and may push up house prices, an oversupply of houses in the local markets will inevitably bring down prices, as power shifts to tenants who can negotiate favourable terms no matter what the inflation environment might be.

– This article is contributed by MKH Bhd manager of product research and development Dr Foo Chee Hung.

Source: TheSunDaily.my

Superb article!! A must read.