Property News

SITE PROGRESS: Straits City (Feb 2021)

About Straits City A proposed 40-acres waterfront masterplanned development by STC Property Management Services Sdn. Bhd. in Butterworth. Strategically located along Jalan Bagan Luar, adjacent to Taman Selat. It is only a mere minutes drive to Penang Sentral, under 15 minutes to Penang Bridge. Find out more about Straits City * Register your interest here ... Read More

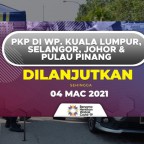

MCO extended in Penang and 3 other states until 4 March, 10km travel limit lifted

The movement control order will be extended in Kuala Lumpur, Selangor, Johor, and Penang from Feb 19 until March 4, says Datuk Ismail Sabri Yaakob. The 10km radius travel limit within the same district has been lifted for all states, regardless of whether the states are under the movement control ... Read More

KPKT to consider applications for moving in and out within strata scheme during MCO

The Ministry of Housing and Local Government (KPKT) has agreed to give consideration for the special approval of moving in and out within the strata scheme during the Movement Control Order (MCO) period. The KPKT, in a statement yesterday, said the application for special approval, however, only applied to those ... Read More

Penang property sector still resilient despite pandemic

The Penang property market is expected to remain resilient despite the crippling effects of the Covid-19 pandemic. Property consultant firm Raine & Horne International Zaki + Partners Sdn Bhd foresees the 2021 market outlook to fare better. This is due to stricter physical-distancing practices, which will entice businesses to progress ... Read More

Penang hotels keen to convert into quarantine centres for low-risk patients

The Penang government has received applications from several hotels that are interested to be converted into COVID-19 low-risk quarantine and treatment centres. State Tourism and Creative Economy Committee chairman, Yeoh Soon Hin said the global spread of the virus had impacted the tourism sector, which saw the hotel industry with ... Read More

Mekarsari Anggun – The Latest Phase of Iconic Mekarsari by Hunza

Mekarsari Anggun - The First Truly Gated and Guarded (G&G) Development at North Seberang Perai, is the latest phase of the iconic Mekarsari by Hunza Properties Group is now OPEN FOR BOOKING. Superior Location in the Pulse of Northern Malaysia Mekarsari Anggun is conveniently well-connected to Penang Island, Butterworth, Bukit ... Read More

SITE PROGRESS: M Vista @ Southbay (Feb 2021)

About M Vista @ Southbay A low density residential development by Mah Sing Group, part of the company’s Southbay township development at Batu Maung. It is located just a stone’s throw away from Free Trade Zone, less than 5 minutes drive to Penang Second Bridge. This development features 237 residential units ... Read More

CIDB orders closure of construction site at SPU

The Construction Industry Development Board (CIDB) has ordered the temporary closure of a hotel undergoing refurbishment at Persiaran Bertam, here for failing to fully comply with standard operating procedures (SOP). Penang CIDB director Zahidi Hashim said inspections carried out found that the main contractor had failed to submit documents and permits related to the construction of a kongsi house (temporary ... Read More

300 Tanjung Tokong residents to move into new apartments

UDA Holdings Berhad (UDA) is providing more than 300 Tanjung Tokong Phase 4A residents in George Town, Penang with new homes at no cost as part of its resettlement project. Entrepreneur Development and Cooperatives Minister Datuk Seri Wan Junaidi Tuanku Jaafar said in a statement yesterday the relocation will begin ... Read More

Anggun Residences – It’s Your Kind of Life at Progressive Batu Kawan

Ingeniously designed upon a condotel concept, Anggun Residences offers the kind of life urbanites have always wanted - Stylish, Cosy and Progressive. Strategically located right next to Design Village Outlet Mall, the first and largest outlet mall in the North, Anggun Residences lavishes you with everyday convenience from easy dining ... Read More

Weekly Newsletter

Latest Projects

TODAY'S MOST READ

RECENT COMMENTS

- trade in density for the affordability. 5700 units in total with 100+ shop units and...BTW on SkyWorld Pearlmont

- Thats why bro, skyworld pigeonhole projects in kl and setapak, looks like battery chicken, now...Goppal Balan on SkyWorld Pearlmont

- @millionaire I concur. Such baseless allegations. ...Justice League on Lumina Residence

- Hebat ...Minion on SkyWorld Pearlmont

- profit maximization of the highest degree, can't believe this is approved, even the birds can...Oh nice on SkyWorld Pearlmont

- who want to stay in this high density hell hole...? ...Oh nice on SkyWorld Pearlmont

- 11 blocks of 40 storey flats? that is crazy... ...Oh nice on SkyWorld Pearlmont

- @1st batch buyer block A How dare you say that? This is million condo by...millionaire on Lumina Residence

- @1st batch buyer block A I have warned but many didnt listen. ...LL on Lumina Residence

- Heard from hardware company staff that the material lumina using all cheap and low quality....1st batch buyer block A on Lumina Residence

SHOW MORE COMMENTS

Latest Property News

OTHER DEVELOPMENTS

- Affordable Housing (Penang Island)

- Butterworth Arena

- Columbia Asia Medical Centre

- Eco-Tourism Hub @ Batu Kawan

- Escape Penang – Eco Theme Park

- GBS @ The Waterfront

- GBS by The Sea

- Gurney Wharf

- IKEA Batu Kawan

- Island Medical CIty

- Kobay Jelutong

- Lin Xiang Xiong Art Gallery

- Linear Waterfront

- Mitsui Outlet Park @ PIA

- One Auto Hub @ Batu Kawan

- Penang Arts District

- Penang Eastern Seafront Development

- Penang Medical & Digital Technology Hub

- Penang Premium Outlets (Design Village)

- Penang Sentral

- Penang South Islands

- Penang Transport Master Plan

- Penang Waterfront Convention Centre

- Penang World City

- PIA Expansion

- Silicon Island

- Teluk Bahang Wellness Resort

- The Ship Campus (ALC College)

- The Top @ Komtar

- Wellness City of Dreams