Condominiums and apartments overhang worsens in first-half 2017

Picture for illustration only

The overhang in stratified properties or apartments and condominiums has worsened, with the number of unsold units rising 40% to 20,876 units in the first half of the year (H1 2017) from 14,792 units in H2 2016.

Deputy Finance Minister II Datuk Lee Chee Leong said the 20,876 units are worth RM12.26 billion and are dominated by apartments and condominiums priced between RM500,000 and RM1 million.

“It is an issue of pricing and affordability as well. Whether this will result in reduced prices, that will depend on the location of the supply, whether the residents around there can afford it or not,” he told reporters at a briefing on the Property Market Report for H1 2017 today.

According to the report published by the Valuation and Property Services Department (JPPH), Kedah surpassed Johor in overhang numbers, with nearly 21% (4,363 units) against the latter’s 18%, followed by Selangor with 17%. Kuala Lumpur made up just 3% of the total overhang.

Residential units that were unsold and under construction also increased, rising 6.5% to 68,245 units in H1 2017 from 64,077 units in H2 2016. The majority of these units too were stratified properties.

Due to the challenging market condition, new residential launches fell 9.1% to 28,397 units in H1 2017 from 31,257 units in H1 2016. Most of the launches were in the RM400,000 to RM500,000 price range with sales performance of 28.9%.

On the construction front, more housing starts were recorded, increasing 16% to 67,662 units in H1 2017 from 58,348 units in H1 2016. Completions and new planned supply reduced to 43,132 units and 43,133 units respectively.

“As at end June 2017, there were 5.35 million existing residential units with nearly 0.49 million in the incoming supply and 0.42 million in the planned supply,” said Lee.

JPPH (operation) deputy director general Dr Zailan Mohd Isa said the 16% increase in residential starts shows that investors are confident in the economy.

“These are investors, billions involved. So if you look at property as an indicator of the economy, it is a good sign of our property industry,” she said.

On whether the market will be able to absorb the new supply of homes, National Property Information Centre (Napic) director Khuzaimah Abdullah said the impact is yet to be seen.

“I am sure the developers are very prudent people. If there are no takers, no buyers, I’m sure they would hold off construction because once you are into the construction stage, there’s no turning back. If you have not started then you can hold on,” she said.

In the office and retail sectors, occupancy rate was above 80% but unoccupied space remained high, with 3.4 million square metres of unoccupied private office space.

Kuala Lumpur recorded the highest unoccupied space with more than 1.62 million square metres, followed by Selangor with 0.87 million square metres.

The retail sector recorded more than 2.79 million square metres of unoccupied space, reflecting an increase of 2.6% from the preceding half. Selangor and Penang Island recorded higher unoccupied space of more than 0.5 million sq metres.

“I must emphasise that both issues – residential overhang and commercial space vacancy are pertinent issues that must be addressed by all parties, particularly local authorities and property developers. Both must exercise due diligence before arriving at development decisions to avoid oversupply,” said Lee.

Overall, the property market continued to soften in H1 2017, recording 153,729 transactions, a decline of 6% from 163,527 transactions recorded a year ago. However, the overall value of transactions rose 5% to RM67.82 billion from RM64.60 billion a year ago.

Lee said the property market is expected to remain soft in the next couple of years but will be supported by various property-related incentives and accommodative monetary policy.

Source: TheSunDaily.my

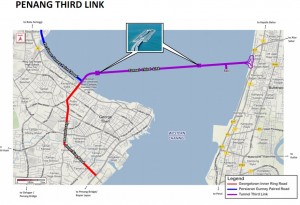

The consortium entrusted to construct the proposed undersea tunnel and two paired highways have downplayed a news report that the multi-billion ringgit project was in jeopardy following the move by one of its contractors, Mudajaya Group Bhd to withdraw from the RM810 million contract that it had won to build the two package roads.

The consortium entrusted to construct the proposed undersea tunnel and two paired highways have downplayed a news report that the multi-billion ringgit project was in jeopardy following the move by one of its contractors, Mudajaya Group Bhd to withdraw from the RM810 million contract that it had won to build the two package roads. by Charles Tan

by Charles Tan

The government’s affordable housing schemes for Malaysians could in the future be a threat to private developers who will not be able to match the lower subsidised prices, Rehda Institute has said.

The government’s affordable housing schemes for Malaysians could in the future be a threat to private developers who will not be able to match the lower subsidised prices, Rehda Institute has said.