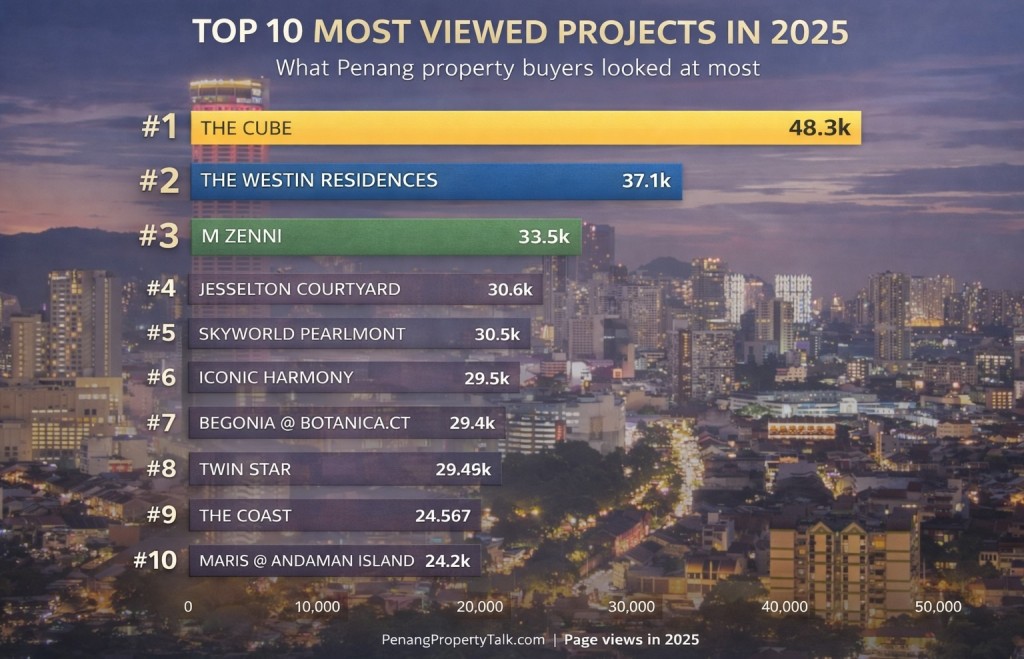

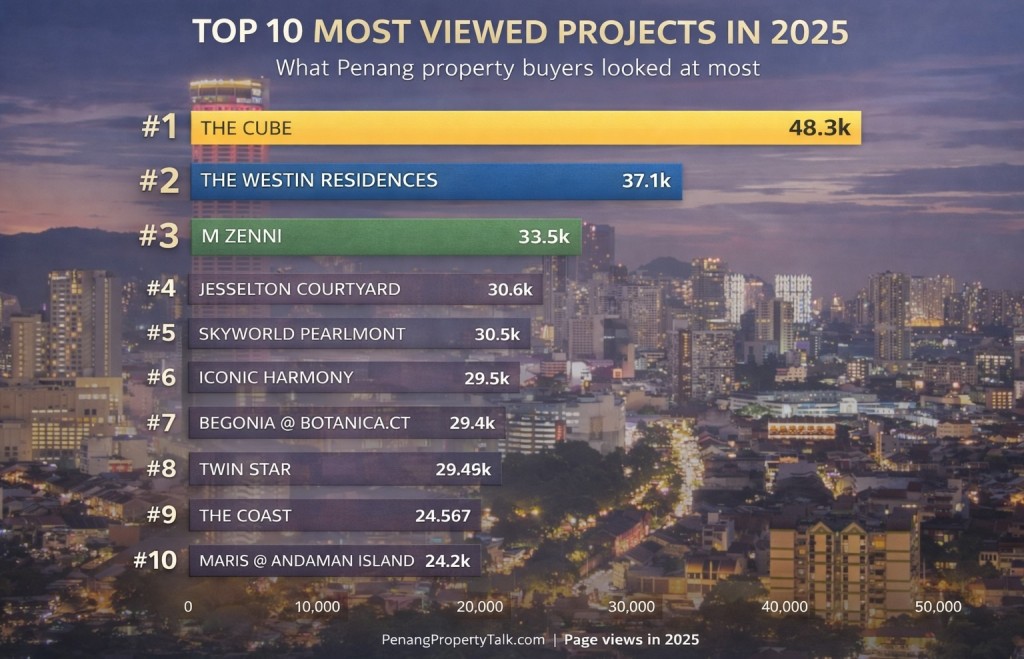

As we move into 2026, we take a look back at the property developments that drew the most attention in 2025, based on page views on our website. This year’s top 10 reflects a broader mix of projects across different price points, with noticeably more developments priced above RM500,000 making the list. The rankings suggest growing interest not just in affordable homes, but also in mid- to high-end and lifestyle-driven projects across Penang.

Once again, The Cube emerged as the most viewed project of the year, maintaining its strong appeal among readers. The list also features familiar names alongside newer and future-facing developments, including The Coast, a concept project by Penang Development Corporation (PDC), highlighting curiosity beyond immediate launches. Join us as we unveil the top 10 most viewed property projects of 2025, offering a snapshot of what captured the attention of property seekers over the past year.

Proposed development by Aspen located along Persiaran Cassia Barat 8 in Batu Kawan. The site is situated next to Central Park and is within walking distance of IKEA Batu Kawan. Its position places the project within an established commercial and residential area that is supported by existing road networks and public amenities.

The proposal involves the development of two blocks of serviced apartments with commercial components. Tower A and Tower B are each planned as 47-storey buildings, comprising 301 units of serviced residences per tower. The units are designed with dual-key and tri-key layouts. In addition, 28 shop units are planned on the ground floor and level 1. There will be 8-level of car parking podium, while recreational facilities are allocated on levels 1 and 8.

Property Name: (to be confirmed)

Location : Batu Kawan

Property Type : Serviced residence

Total Units : 602

Built-up Size: (to be confirmed)

Land Tenure : Freehold

Indicative Price : (to be confirmed)

Developer : Aspen

Subscribe here for updates on this project and other property news

DISCLAIMER: This article is solely based on research done using publicly available data. This is not an advertisement. Any claim, statistic, quote or other representation about a project or service should be verified with the developer, provider or party in question.

About Jesselton Courtyard

A luxury residential project by Berjaya Land in the Penang Turf Club area. It features 32 units of Four-Storey Zero-Lot Bungalows (6,649 – 9,054 sq.ft.) with an indicative priced from RM6.48mil, and 207 units of 1½ – 2 Storey Condominiums (2,734–5,167 sq.ft.) with an indicative priced from RM2.87mil. Averagely around RM1,000 per sq.ft. It is surrounded by affluent neighbourhoods of Jesselton and Pulau Tikus and close to the Youth Park and the Botanical Garden.

Find out more about Jesselton Courtyard

Register your interest here and we will keep you updated.

Taman Tempua Indah is a residential development located in Nibong Tebal, situated near the junction of Jalan Permatang Tok Mahat and Jalan Murai. The site lies close to the Penang-Perak border and is approximately 2km from Parit Buntar KTM station and the nearby Mydin hypermarket. It is also within about a 10-minute drive from the Jawi toll plaza on the North–South Expressway.

The project comprises 2-storey semi-detached houses offered in two layouts. Type A consists of 24 units with a land area of about 3,531 sq ft and a built-up area of approximately 2,428 sq ft, featuring five bedrooms and six bathrooms, with prices in the RM700,000 range. Type B comprises four units with larger land sizes of around 3,671 sq ft and built-up areas of about 2,852 sq ft, offering five bedrooms and four bathrooms, with prices in the RM800,000 range.

Project Name : Taman Tempua Indah

Location : Nibong Tebal

Property Type : Residential

Tenure: Freehold

Land Area: 3,531 sq.ft. onwards

Built-up Size: 2,428 sq.ft. onwards

Total Units : 28

Indicative Price : RM700,000 onwards

Developer : Primawangi Sdn. Bhd.

Register your interest here for updates on this project and other property news

DISCLAIMER: This article is solely based on research done using publicly available data at the time of publication. This is not an advertisement. Any claim, statistic, quote or other representation about a project or service should be verified with the developer, provider, or party in question.

Begonia @ Botanica CT is now completed with CCC obtained, offering move-in ready homes in the serene township of Botanica.CT, Balik Pulau, Penang. With only limited units remaining, this is a rare opportunity to own a completed 2-storey detached freehold home in Penang—without the wait.

Own a move-in ready home today and enjoy a limited-time New Year Promotion, where eligible purchasers stand a chance to win attractive prizes worth up to RM40,500*. Homebuyers are also entitled to a FREE First Term at Prince of Wales Island International School (POWIIS) Balik Pulau*—a valuable benefit for growing families. Terms & conditions apply.

New Year, New Prosperity 2026 Promotion, till 30 April 2026:

- 1st Prize: Home Renovation Upgrade Package worth RM15,000*

- 2nd Prize: Home Furniture Package worth RM12,000*

- 3rd Prize: Landscaping Package worth RM10,000*

- Consolation: Five (5) winners will each receive a 1g Gold Wafer worth RM700*

A freehold strata landed housing development by MTT Properties & Development Sdn. Bhd. at Botanica.CT, Balik Pulau. The project spans approximately 4 acres along Jalan Sungai Air Putih 5, right next to POWIIS, and is just a few minutes’ walk to Botanic CT Centre. This is the first gated & guarded community in Botanica.CT, featuring 60 units of 2-storey semi-detached homes across three design types.

Act Now!

Don’t miss this golden opportunity to own your dream home and stand a chance to win exceptional prizes worth up to RM40,500*!

Call: 04-866 2399 / 012-865 3699 / 012-495 8699

WhatsApp: wa.me/60128653699

Visit the Show House Today!

Discover why everyone is talking about Botanica.CT – The Garden Township.

Register your interest here