The draft 2030 Seberang Perai Local Plan (DRTSP2030) has managed to gather a total of 2,559 feedback from the residents on the mainland through the public participation.

Seberang Perai City Council (MBSP) mayor Datuk Rozali Mohamud said the public participation was held for three months starting from April 12 until July 9 this year.

“The public was given the opportunity to make suggestions and submit their objections online in view of the Covid-19 situation.

“After all, the purpose of publicity and public participation is to encourage the community to be equally involved in planning the future development of their area through DRTSP2030.

“And I am glad that MBSP has received a positive and encouraging feedback from various quarters in Seberang Perai for the draft local plan.

“Thus, I would like to thank them for all the valuable feedback,” Rozali told reporters via online at the MBSP headquarters building in Bandar Perda, Bukit Mertajam yesterday.

The proposed blueprint contains a development planning strategy in Seberang Perai until 2030. It includes three main cores, namely competitive, inclusive, and greenery and is also supported by 18 strategies and 52 proposals.

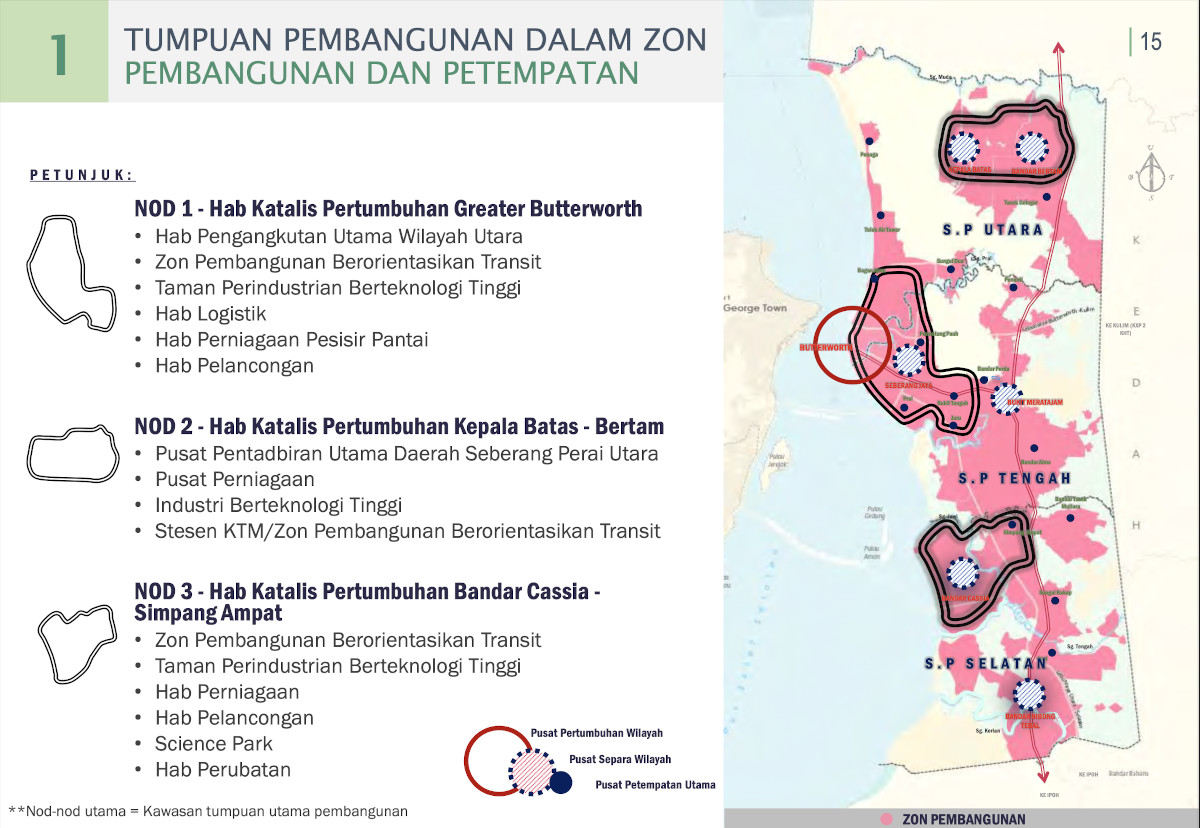

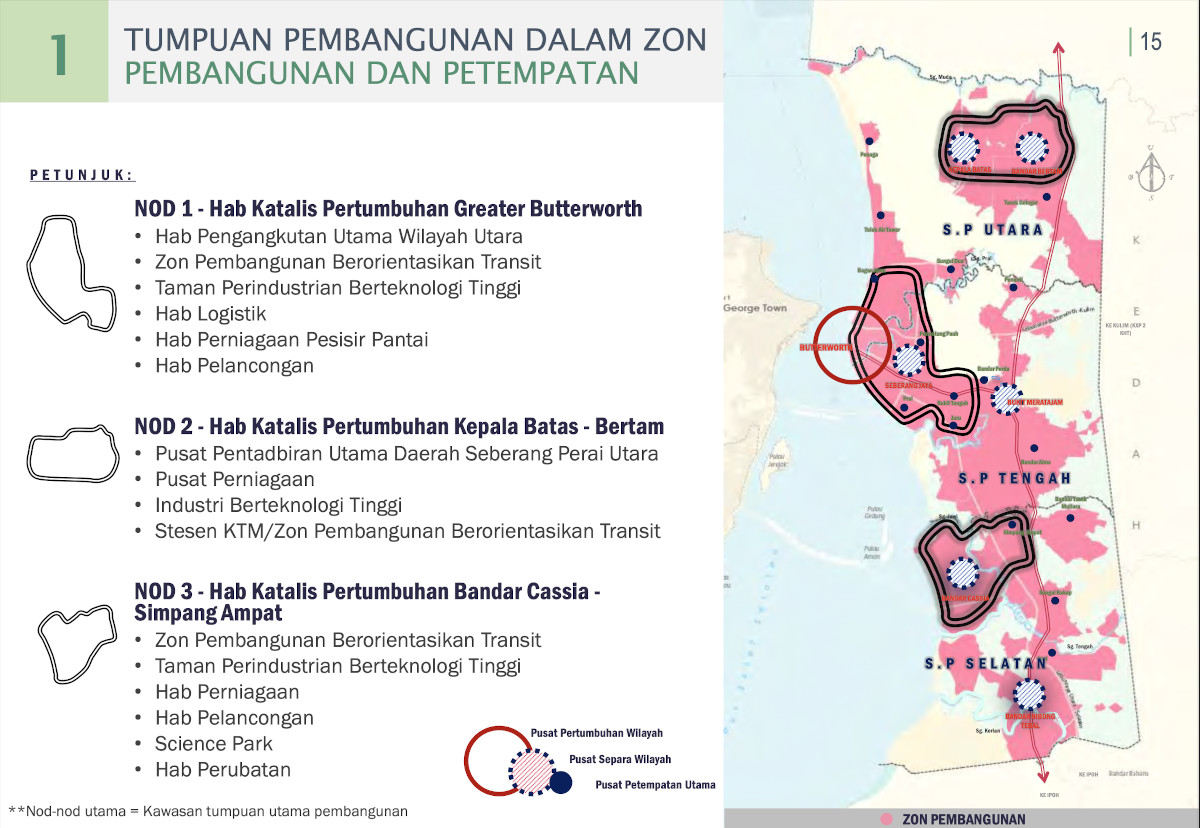

In the proposal, three major development zones (NOD) have been identified to function as catalyst hubs: NOD 1 – Catalyst Hub for the Growth of Greater Butterworth; NOD 2 – Catalyst Hub for the Growth of Kepala Batas-Bertam; and NOD 3 – Catalyst Hub for the Growth of Bandar Cassia-Simpang Ampat.

NOD 1 will oversee the development of Greater Butterworth, and the linking of the Bagan Ajam, Seberang Jaya, Bukit Tengah, Perai, Juru, Permatang Pauh and Butterworth townships as part of the northern region’s transportation hub. The development of a high-tech industrial park is also in the pipeline, as are a logistics hub, a coastal commercial hub and a tourism hub.

NO2 2 will be transformed into the main district administrative centre for North Seberang Perai, with plans to develop the townships of Kepala Batas and Bertam into a commercial centre to house various high-tech industries.

Further south is NOD 3 which will be promoted as a commercial and tourism hub. To encourage economic growth, a second high-tech industrial park and a science park will be established there.

On transportation, seven areas have been identified as Transit-oriented Development (TOD) Zones. Those areas are divided into three development zones. TOD 1 at Butterworth will be the main transportation hub for northern Malaysia, while TOD 2 focuses on the townships of Bukit Mertajam, Nibong Tebal and Bandar Cassia. TOD 3 will in turn concentrate on the smaller townships of Simpang Ampat, Bukit Tengah and Tasek Gelugor.

For easy commute, selected locations along the transportation network will also offer park and ride services, including the train stations at Simpang Ampat, Tasek Gelugor and Nibong Tebal, as well as Permatang Pauh, Macang Bubok and Bertam.

A “20-minute city” concept is also included in the plan, in which the walking distance between each urban public facility such as recreational parks, commercial centres, public transportation facilities, educational institutions and public hospitals are all within 20 minutes’ reach.

You may find out more about the draft 2030 Seberang Perai Local Plan at the official site below:

https://www.mbsp.gov.my/index.php/en/component/content/article/136-draf-rancangan-tempatan/518-draf-rancangan-tempatan-daerah