Penang land tax revision explained as state urges owners to appeal if dissatisfied

Penang Chief Minister Chow Kon Yeow has clarified that the revised land tax (quit rent) rates are calculated using a formula based on four factors: whether the land is classified as urban or rural, its size, its current use and the applicable tax rate.

Speaking at a press conference in Komtar, Chow addressed public concerns over cases where land tax bills appeared to increase sharply. He urged affected landowners to submit an appeal to the Land Office if they believe their assessment is incorrect.

“The bottom line is to come forward and appeal with your documents. If the case is genuine and the land classification needs to be corrected, we will reassess it,” he said.

Chow explained that the revised rates follow the framework gazetted under the Penang Land Rules (Amendment) (No. 4) 2025 on Sept 11 last year. Land tax is calculated by multiplying the land size with the rate assigned to its current use.

For example, residential land is taxed at RM0.70 per square metre for urban areas and RM0.50 per square metre for rural areas.

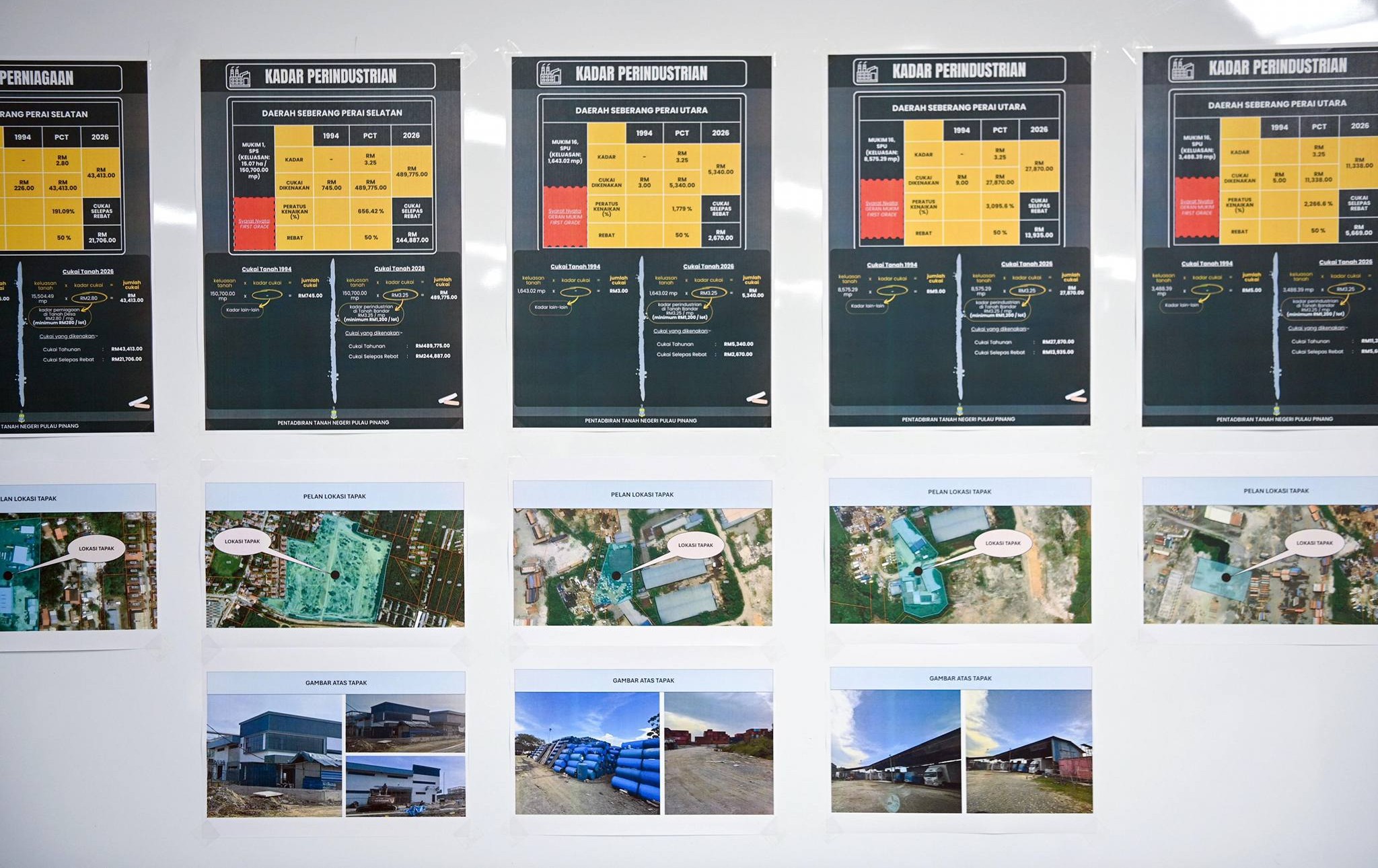

He noted that some examples circulating online — such as taxes rising from RM6 to RM19,400 or from RM745 to RM489,775 — were likely due to changes in land use classification. If land previously used for agriculture is now categorised as industrial, the tax payable would naturally increase.

Chow cited an example where a five-hectare parcel used for paddy cultivation could see its annual tax increase from about RM50 to RM162,500 if reclassified for industrial use.

He stressed that the revision aims to create a fairer and more equitable system by aligning tax rates with actual land use while removing disparities between First Grade and non-First Grade lands. Penang’s land tax rates had not been reviewed for more than 30 years, with the last revision carried out in 1994.

The state government has also introduced transition measures to ease the impact, including rebates of up to 50 per cent, a full waiver of late payment penalties and more flexible grounds for appeals.

Meanwhile, Penang Land and Mines Office director Datuk Dr Faizal Kamarudin said about 300 appeals have been received so far, with roughly 100 involving First Grade lands. This represents less than one per cent of landowners in the state.

Faizal added that only two states in Malaysia — Penang and Melaka — have First Grade land classifications.