Penang Island vs Mainland (Part 2) – Land scarcity or abundant?

Land scarcity or abundant, which one is better?

Scarcity of land is one of the most common explanations given by those looking to invest or having invested into a property in Penang Island. Many people seem to have convinced that since the island is running out of development land, prices of houses should increase at a much higher rate than any other places, including mainland.

Theoretically, the assumption is correct and that the land price increases are often sustainable too. But one should also be clear with their property investment objective. Are you looking to invest into an expensive property or a property with high investment value? Land scarcity will result into higher property price, but not necessary property with higher return on investment.

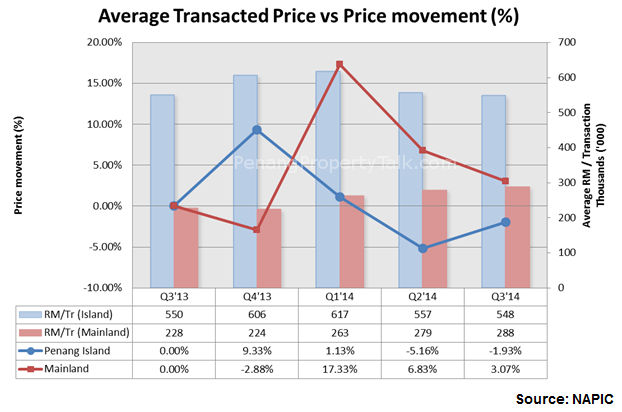

In reality, as the property is getting more expensive, a higher price resistance among the buyers would be seen. Especially when it goes beyond the psychological price limit of the majority, people will need more time to accept the higher limit. The chart below shows the average transacted price and average price movement, based on the combination of 3 most popular residential property types – Condominium, 2-3 storey terrace and 2-3 storey semi-detached houses.

The data from NAPIC clearly indicated that the residential property transaction in the mainland has shown a higher degree of positive price movement as compared to the properties in the island.

Under the influence of land scarcity, some people has opted with the “buy first, think later” strategy and believed that if they don’t buy a property in the island today, they might lose the opportunity later. Some went to the extent of buying property at western part of the island without having a clear objective in mind. Of course there is nothing wrong if that is planned for own stay. But for investment, bear in mind that all houses built are eventually meant for human habitation. The livability of the property and location should be the utmost priority.

One should focus on the investment objective and land scarcity ought to have the least influence here. If your objective is to own a property in Penang Island as a brand, and that you admire a busy urban lifestyles, north east district of the island is probably your best option. But if you don’t mind to spend additional 10-20 minutes traveling to your workplace, the abundance of land in mainland may be able to offer you a more relax lifestyle with myriad of outdoor activities that your whole family can enjoy in the future. Most importantly, it is likely to cost less than half the price that you will be paying in the island.

It is my firm belief that the increases in property price have very little thing to do with scarcity of land. Whether it is in the island or mainland, a general uptrend in land prices will inevitably results in more expensive houses. However, a sustainable property market price is when people are convinced and perceived that the premium they have paid is reasonable for a lifestyle the house will bring them.

OTHER TOPICS:

Penang Island vs Mainland (Part 1) – Location branding

Penang Island vs Mainland (Part 3) – Connectivity & Accessiblity

Penang Island vs Mainland (Part 4) – Population

– Ken Lim

(Founder and Principal Reviewer, PenangPropertyTalk.com)

Inevitably Eco World has to appear…..is it not obvious to everyone now, Ken?

Yes, EcoWorld has to and they will appear. Since they are one of the biggest landowner in Batu Kawan, they are going to play a very important role in its success.

how are penangites able to cope with the property price? for myself, i can’t even fetch the salary that i am getting in kl if i were to work in KL..

Buy property according to your capability but many time people are more concern about their status and pride.

Based on 30 years loan repayment at 4.4%

RM200,000 = RM1000 per month

RM300,000 = RM1500 per month

Some of the available apartments for sale

Desa Indah, Relau = RM188,000

Sri Ivory, Farlim = RM250,000

Permai Ria, Tanjung Bungah = RM285,000

Permai Jaya, Tanjung Bungah = RM280,000

Halaman Kenanga, Sungai Nibong = RM245,000

Greenlane Heights, Greenlane = RM180,000

There are so many other apartments for sale in the market.

With the new affordable home price at

RM300,000 = 90% loan RM270,000 = RM1352 per month

RM400,000 = 90% loan RM360,000 = RM1802 per month

Again we have the option to choose a new apartment or to purchase in the secondary market based on your own capability.

Change is constant and prices will keep on increasing because there is no such thing as price will drop when population is growing and supply is insufficient. Houses which were sold 30 years ago for 60,000 will not be sold for RM60,000 but instead RM800,000-RM1,000,000 now. If you do not plan to purchase now, the prices of houses which is RM300,000 will eventually be worth RM600,000 in 10 years time or even more.

Put our pride aside, things will be different. The rich are also staying in location like Farlim, Relau, Balik Pulau. So do not worry how people will think or look at you based on your home location.

A cup may be dirty from the outside but it is crystal clean inside which I rather have than a cup which is clean from the outside and dirty inside.

@Property 123

well said.

any good property review for mainland?

@Property 123

Moreover our currency is dropping. This will also cause the house pricing to increase.

Maybe from initial RM800k to >RM1.2m in few years time……

What do you think ?

@Property123

What you said is totally wrong.

Wrong #1 –> You said “there is no such thing as price will drop”

Yes, THERE IS. In fact, asking price has come down ~10% in Penang over the last 3 months.

Wrong #2 –> You implied that in terms of capital appreciation, no matter what or where you buy, you still enjoy capital gains in the long run, and it makes no difference.

Well, the difference between rich and average people is the rich “outperforms” the rest. If everyone else double up their capital, while you triple, that makes you rich compared to the rest of average joes. So, don’t simply buy.

Wrong #3 –> You said “The rich are also staying in location like Farlim……So do not worry how people will think “.

The fact is, if you’re someone driving an expensive car (eg. Merc CLS and the likes) living in Farlim, there is 98% chance that you’re either an AhLong or Drugtrafficker/processor. At least that’s how people would look at you.

@slitty

I cannot tahan but to response to you on your last statement. How can you generalize most of the rich people in Farlim as Ah Long and Drug trafficker?

I foresee in both island and mainland that master plan development will be the trend and also the preferred choice by buyers as compared to stand alone projects because of the added value such as commercial, schools and other amenities.

For mainland Aspen Group and EcoWorld will path the way because of their master plan concept. Both have different approach and strategy.

EcoWorld (EW) their strategy is always on their awesome surrounding concept and luxury living. Beautiful landscaping, waterscape, marina, golf course and etc. This also means that purchaser also will have to pay a higher price for their homes. EW will for sure drive the property price up in the mainland.

Aspen Group (AG) their strategy is selling at affordable pricing with their master plan that includes both residential and commercial. I am expecting that their price will be at least 20%-30% lower compared to EW. However, with IKEA coming in, it will for sure boost up the capital appreciation for properties surrounding it once it is completed.

However, we have to remember that for the whole area to be developed it will take at least 5-10 years. As for the first 3-5 years after completion it will still be quiet as people are slowly moving in and not much activities will be happening yet as we can see from other master plan development. (example, Seri Tanjung Pinang, IJM The Light, Setia Alam or Mutiara Damansara where IKEA is currently located)

Prices will really start booming after the 5th-6th year after completion when more people have moved into the area.

It is human nature, when we only see a few lights around the area we always call it a ghost town and people will say who is going to stay here. But give it some time and people will eventually move in and where there are more lights in the area, it will automatically draw the crowd.

Again depending on buyer’s needs and financial capability but for mainland I will keep an eye on these 2 companies.

On the island, I will keep on eye on Seri Tanjung Pinang 2. I think it is an exciting project as E&O and the location has proven its success and it will also be a major transformation at Gurney Drive and Tanjung Tokong which will surely benefit everyone in the future.

As for pricing, we can see a steady increment of 7%-10% in Penang on a yearly basis. So if a house is sold for RM800K and in 4-5 years time it would be valued around RM1.2m form statistics.

IssacTan,

Currency Drop will cause an increase of demand from foreigners. Foreigners will have stronger buying power. However, the local will still draw the same amount salary. Malaysia property are mainly local buyers. While there are foreigners, the % is not huge.

Also, it depends the cost of materials to build a house for new development. For materials that are import from other countries, a drop in currencies may cause the cost to increase.

However, the increase is insignificant.

Property price movement will largely depend on supply and demand in the market instead.

Slitty,

Your arguments are flawed.

#1 Property 123 is referring to the fundamental and taking a long term perspective. You are however, timing the market. All investments has up and down. Taking shares for example. in 2008/2009, shares drop drastically, but because fundamental is there, it recovers over time.

I agree with property123 in the view that population is young in Malaysia and there will be a demand. Aso due to inflation, things will naturally get more expensive overtimes.

Also, just for your information, I took a liking for a bungalow at tanjung bungah. It was first asking at 3.6M in Jan 2015, Today, it is asking for 3.8M. Also, Asking price is not an indication of true value. You will need to look at transacted price instead.

#2, Definitely rich people has more means of growing their wealth. This is a fact. However, one does not need to compare with others on your life/investments. If everybody who buys property double their wealth, while one or two triple. good for those who triple, but at least I double my wealth and able to lead a better life from the investment. It is better off than I dont do any investment. Base on your logic, if everybody double, and if I dont do any investment, I will be poorer instead.

Being rich is not about how much more you gain compared to others.

#3

That is an assumption and your perception. It is not a fact.

@Property 123, I think 5-10 years not enough. Probably 15-20 years. Batu Kawan so big!

I think STP 2 is going to cost at least 3x more than Batu Kawan.

@KTLai

Yes, I know you cannot tahan, but it is an undeniable fact. It is public perception, cannot be changed in the short term. In fact, there’s nothing magical living in Tanjung Bunga/Tokong, but again, it’s the perception. And over time, the perception fulfills and reinforces itself, therefore polarizing into prime and secondary locations.

Property123 asked people to put aside status and pride, which is impossible. Without status and pride, you’re just as good as salted fish.

@ko

Thanks KO. But i thought gov still promoting Penang as the second home to foreigners or has it been stopped for long?

Hope the LRT project will materialize to help Penang growing further…….

slitty,

Like ko said, that is only how you perceived, not public perception. At least i don’t perceived it that way.

IsaacTan,

You are right, Penang is promoting a lot on MM2H. However, based on current statistics, foreign buyers stand at a very low %. Sorry, I dont remember where I saw the statistic, but i seen a few times over a period of times.

LRT will help the transportation in Penang, I however, hope that Penang will do more to attract talents from other states. To help spur property price, a young population and an increase in population will help.

@ko

Thank you for your interest.

#1 The share market during 2008/2009. This is a very relevant example. You are right to say that those who invested heavily before the crash finally recovered their losses 3 years later when the market recovers. HOWEVER, those who invested heavily DURING the crash doubled or tripled their investments 3 years later, instead of recovering. There’s a hell of a difference.

#2 Rich/poor is relative. Without rich people. they won’t be poor people in this world, and vise versa. Happy/sad is relative. If you’ve never experienced sadness, you won’t know what happiness mean. For those who are first time buyers, pls seriously consider state affordable homes. For those who are thinking of getting rich by investing in properties, pls don’t simply buy. Make sure you buy the right thing at the right time. That’s all I’m saying.

#3 A major developer paid a consulting company a 6-figure sum to do a market analysis and survey in Penang on housing after few failed attempts to sell their new properties, and this is one of the conclusions. That’s why the developer had to revise their project concept in Paya Terubong. It’s not my perception, it’s real hard data.

@ko

Hahaha…..I think you have been sleeping for the last 12 months.

The state’s main objective now is not to spur property price. On the contrary, moderating price is high on their agenda. It’s written all over the wall my friend. Still dreaming?

Slitty, I think you have a problem with reading. I said, I hope. It is my personal opinion and desire that penang do more to attracts more talents from other states, to create more demand. From an investor point of view.

Government will always tried to moderate growth to avoid a bubble. Which is the right move, but is not what I am referring.

Read more carefully.

My dear friend, if everyone puts status and pride first, then everyone will be driving a Ferrari.

I always tell my friends and buyers, we should live by your financial capability and needs. This applies to purchasing property as well.

You will be surprise, the super rich sometimes are even driving Perodua or Proton. Not every rich person live in Jesselton too. So it is totally not right to categorise a person based on the location he/she is staying.

You are talking based on your perception but the truth is that statistics and facts are even more accurate.

Penang primary market increased by 48.9% in sales last year (2014) compared to 2013 based Henry Butcher property survey report.

Reading through I Property report based on Malaysia market. Survey shows that 64% of Malaysian choose to invest in Penang for their next property.

I always tell property sales person, if we educate our customers with the right information then they will not have the wrong perception.

Hi IssacTan,

Just incase you are keen to know, the number of foreign buyers in 2012 is 8%. The link as below

http://www.iproperty.com.my/news/5059/how-is-the-penang-property-market-doing

I remember reading somewhere as well in 2013 and 2014, the number is also below 10%.

#1 You are timing the market. Investment is done and take into consideration of current situations. No one is a fortune teller to forecast how market is going to be. As a private banker myself, I can tell you, I do not know how market is going to be tomorrow. Those that invested during the crash, good for them, otherwise, wait thru the downturn. Or simply just put your funds into FD

#2 Rich is a very subjective term. You can never compare. A client with 10M cash and a client with 100M cash has different instruments to get different returns. You are right to say and advice not to buy with the hope of getting rich. I would also like to advice to know what you are getting into and to consider what your strategy will be during a downturn. And if for investment, what happen if you are unable to rent out.

#3. Which developer? Which consulting firm? Whats the 6 figure sum we are taking about? What is the study about? Nevertheless your comments seem like the study is how to improve the sales of the property and not about MErc drivers staying in Farlim is 98% drug trafficker or loan shark.

@ko

Thanks KO for the link.

In your opinion, which are the best next target area in pinang island?

@KTLai

This is exactly why I said the price has to come down b4 it can go up!

The property market has peaked (for the short term ) ,but many property agents refuse to believe it or try hard to misleading many young people.

Buying a property is a big capital expenditure & TIMING is really very important.

@slitty

Totally Agreed!

This is exactly why I said the price has to come down b4 it can go up!

The property market has peaked (for the short term ) ,but many property agents refuse to believe it or try hard to misleading many young people.

Buying a property is a big capital expenditure & TIMING is really very important.

Hi IsaacTan,

Take a look at the master transport plan. The areas that benefits from it has good potential. I feel that areas next to /nearby the prime area has better upside than prime areas in island. For example, island glades. However, on a more personal level, I am looking at jesselton / tanjung bungah for land only and houses at tikus/tokong/bungah. I am also looking at mainland raja uda side.

Hi KC,

In my opinion, for investment purpose, one can still decide to time the market. Just need to make sure that when the market really drop, wont be scare to go in. It is an investment decision.

If one decided to time the market, then questions to ask will be, when is the right time? Drop how many % then is the right time to enter?

However, for first time buyer or for own stay, the best time to buy is when one can afford and when manage to find a good property that they like.

During bad times, it is also really not an easy task to find a property too.

Hi ko,

During bad times not easy to find property? You must be kidding me! Look at Bayan Baru, there are plenty to choose from at RM400++ psf. If you go Farlim Shineville condo, it’s RM300++psf. These are just a a few examples of properties which prices have retracted from previous transacted high for at least 20%. And there are still plenty of nervous sellers at this “discounted” price. Good for those who did not rush in to buy 6 months ago, pity those who listened to “bullish” irresponsible “property experts” and bought these properties at “historical highs” months ago.

@ko

Thanks….tokong already looked into.

Will look into Bungah next but the problem is the road was too narrow and always congested.

When you said land, is that mean you were looking for landed property?

@icysoda

I have been trying to get a unit in Shineville for the past 6 months for even at RM

400 psf. still not successful for a town view unit. At RM 300 psf. you must be

sleeping.

Agree. Many people still “believe” price of property will go down regardless mainland or island

What I have experienced is that even during the so called bad times last year. People are still selling at market price as I have never sold anything which is below market price.

There are many empty units because purchasers from Penang has one of the highest holding power. On the other hand many purchaser bought for their children and have not handed over the house to them due to their young age.

When I say market price it means that the price which was provided after going through valuation.

Valuation price = Suggested Market value

Force sell price = Below market value

As long as the owner do not sell at force sell price then the property is still at market price.

Valuation = RM500K

Force Sell = RM350K

Valuation price is also set to indicate that it is the maximum loan amount a bank will lend to a borrower.

A owner can sell at RM450K too if he/she decided too. This is still consider market price.

However, in many case property owner always have a higher opening price.

Example, many owners know that if their property is valued at RM500K they will have an opening price of RM550K (negotiable)

So even if they sell at RM500K it does not mean that property price drop by 10%. Just that it was sold at the suggested value.

Many people do not understand this part and when a property is transacted anything less than the opening price, people will start saying property price drop.

As long as it is not force sell, it is not below market value.

Agree. Owner can ask as much as they way and probably over price…. while bank doesn’t allow to loan so much and the owner needs to give discount price…

when owner give discount price, many will say this and that.. say the market slow down and house price has decreased… this is so wrong after all…

Just like what u say, the value by bank is 500k and the owner ask for 600k… when when they sold for 520k… many said the price descrease 80k..

Hello peeps, the owner already know that the house is worth between 500k to 520k and he sold for 520k. is this a loss or price decrease? Not so…

Agreed! Agreed! Even there is someone force sell below market, that could be just because he is unable to serve his loan. But that doesn’t represent the overall market

Anyone can suggest a new project to invest in mainland?

i think mainland secondary property are more diffiuclt to sell compare to island even the return is higher.

Hi Icysoda,

During bad times, there will be limited supply/sellers as well. It will be harder to find a property that meets all your requirements. it will be easy if you dont mind any property or no requirements.

Well, I cant comment on the pricing on the area you mentioned. However, I am certain that those who bought 6 months ago will not be looking to sell at the moment. Property is long term investment. With current RPGT, 5 years to avoid the tax also. for flippers, i doubt they will look at these areas.

If you are so concern, dont buy and enter when you think is the right time. Just need to decide when is the right time for you.

Its good to note that transacted price is the price we should always see and compare with.

And last year is not a bad time la. It is just a slight slowdown in the number of transactions. Bad times is too strong a word to use for last year. lolz

You looking for investment or own stay? I too find the road too narrow at bungah. lolz

Land only = Land without any buildings. I am looking for investments or if cant sell, will construct myself to stay for retirement later on. Construct myself will save a lot of $$.

I also take a view that land will appreciate over times while buiilding will depreciate over times. So mainly looking at landed houses for now.

Hi newbie,

You need to set some requirements yourself too instead of asking such generic question and invest based on hearsay. Requirements you need to decide is type of houses, budget, location, facilities, rental yield etc etc etc

Perhaps if you list down some of your requirements, the people here will be able to suggest some properties for your consideration. Otherwise based on your questions, people will recommend based on their requirements.

Do consider subsales also if for investment. Sometimes can get a good buy. Ya sometimes. lolz

Penangnites really seems to be loaded. Shore front selling at RM2100psf also got snapped out. Really no suprise if the property sector is heading at least north least if is not north again.

Hi guys, kindly give me a piece of advise regarding the pearl city in Simpang Ampat.

Not for investment, for own stay.

Is the place really that “ulu”??

I went there and there is developing. Pearl city mall, international school, shop lots…

Thanks thanks…

If u working in mainland, that place isn’t bad.

@Go4mainland

Currently not working in mainland.. since not so soon complete. If later stay there maybe will work at batu kawan industrial area lo. T.T

If any developer launch something reasonably priced, I will surely consider buying something for my retirement.

Reasonably priced means gated landed terrace homes at around 400k. Beyond that, it’s not worth it.

so penang island price is -5.16% in Q2 2014 and -1.93% in Q3 2014. Peak sign?

How about Q1 2015? Any data? Tq.

Price is in downtrend after end of 2013.

@ko

for investment or maybe own stay….

@retiree

400k? maybe far far away land in penang island?

Hi IsaacTan

I meant BK. I don’t mind something in BK for my retirement if the price is right. By then, all the amenities will be there.

Hi All,

i’m a newbie here. I’ve narrowed down to a 1-Bedroom apartment (877 ft) at 18 East Andaman (next to Straights Quay). It’s on the 10th Floor and Garden / Pool Facing. The unit is expected to be completed around end of 2016.

I’m doing this for mid-long term investment. How is the rental market for the type and size of the unit mentioned above? Any what type of yield (both rental and capital gain that i can expect). I’m not familiar with Penang, except for occasional visits for holidays.

I’m looking forward to honest opinions. Thanks

hi Salahja,

18 East Andaman is selling at a very much higher premium than Quayside. I had a 2000sqft unit in Quayside seaview and was interested to get another unit last year at 18 East Andaman as the rooms layout is much better than quayside with 2 master suites. However, I did not as the price premium over quayside made me felt like a fool.

Rental market in penang is bad in my opinion. Really bad. lolz. The rental yield for my quayside at high floor seaview was about 3.7%. For condo in penang, rental yield range from 3-4%.

I am unable to comment on a 1 bedroom size as I am unfamiliar with this category.

As for capital gain, I doubt anybody can answer you as no one has a crystal ball. Since completion, Quayside didnt move much. It appreciate, but not significant.

Hope the above is useful

@Salahja

Sounds like you’re a foreigner. This is not the right time to buy in fact. Like ko said, rental yields are pathetically low (by Msian standards). Of course, if you compare to Spore, the yields here are still pretty decent. But one thing you have to take note of. In penang, it is not easy to sell a property. You’d have to wait for ages to find a genuine buyer. Unlike Spore, if you price your property fairly, you can sell a property within weeks with multiple offers. In Penang, most of the time, even at a -15% below last transacted price, you’d have to wait and wait and wait. So it’s very illiquid. Things are very slow at the moment. You’d just have to wait….and wait.

@ko Hi Ko, Good morning and thanks very much for sharing your views. It’s definitely helpful.

When i was looking at the units, the developer was saying that they are projecting a rental yield between 4.5 – 5%. However, most of the reports / forums on the internet says otherwise.

Based on what i have read so far, i can summarise as follows:

1. Don’t expect the rental cover your mortgage payment. If I’m lucky, i can get about 3k for rental of this size of unit and the rest i need to fork out, which is another half.

2. Capital appreciation in Penang is in the range of 8%-10%. This seems to be the typical. Even at 5%, it is still attractive. However, i wonder who would be the typical buyers for 1 BR units, let’s say 5-10 years time.

This is the first property that i’m buying for an investment. A unit in this location attracted me, mainly because of what i’ve heard about this whole development being a “community”, the feel, the safety (crime rates)… and of course, the so called projected capital appreciations of 10% during the past few years…

Any more views on these would be appreciated from anyone. Thanks a million, folks…

Hi Salaja,

This location really attracts a lot of foreigners, no doubt. Very good living environment, no doubt. When the developer told you there’s a capital appreciation of 8%-10% yearly for the past 5 years, that’s also true. But you have to understand, like stock market, there is the bull cycle, the bust cycle, the bear cycle and so on. You won’t be seeing that 8%-10% in the coming years, especially when your entry cost is so high.

Investment return aside, no doubt, this is the best area to stay for foreigners and the wealthy.

@Salahja

Buy a property at this time when market is peaked (short term 1-2 years) for investment is not advisable, esp for high end Condo.

As you have said at the beginning, this is an investment, don’t fall in love for this particular property for an Investment, the Timing will determine your returns.

@Buyer Hi Buyer,

Thanks for your input. You’re right that I can’t be looking at 1-2 years for a good capital appreciation. I’m actually looking at about 10 years or more. In that case, would it be a good move?

On a separate note, what is the typical mortgage interest rates in Malaysia? I know that we don’t have the crystal ball to predict the future. Having said that, I’m keen to know all of your views on the projected interest rates moving into the future… Any guesses?

Do not entertain those telling “grandfathers’ stories” because these people need

advertisement and they are doing their work only.

Hi Salahja,

Do be informed that Quayside does not experience 8-10% appreciation for the past few years. Less than 1/2 of that.

I am not sure what is the developer selling for a 887 sq ft 1 bedroom at andaman. However, I am certain for that amount, there is other projects with better potentials.

a 10 years to 15 years is generally a good timeframe. You cant really time the market. You should however take a view of the market and decide if you should enter. If you feel market is still going to grow, enter. If you feel market is going to crash. then wait.

Malaysia Overnight borrowing cost is currently at 3.25%. Been maintaining at this level since last yr.

For mortgage loan rate, you can look at 4.45% for now. I take the view that the range of interest rate movement for mortgage will be 3.8% – 6% (bad times – good times) for the next 10 years.

I assume you are a foreigner, do note of the various taxes involved.

@ko

Good advise! Very informative. TQ ko

Hi Salahja,

Just to add on, 1 bedroom you are targeting couples without kids. For such high end condo, may not be that affordable to the young married couple. A pretty niche segment I would say.

Hi Kokomo, seems like you are in sg too. Actually rental yield here in SG is about 3% too. Just that mortgage loan rate here is much lower than malaysia.

You are right, property in SG is more liquid. It is definitely slower and harder to sell in Penang. Different market I would say. Malaysia is attractive for property investment 1) because it has a very nice demographical population, unlike SG where the population is aging. 2) Malaysia is bad in the financial sector where there is a lack of financial instruments for investments unlike SG.

Hi ko,

No I’m not in Spore, but I have links in Spore. I am a local Penangite. I have lived in Spore for a while, and then found that Penang is more suitable for old farts like me.

@Salahja

Penang island have a excellent track record for continuous appreciation. In some bullish years will be much better than others. Currently bearish trend but reports are showing a turnaround. Give it some time it will definately appreciate.

Rental is horrible in Penang. If you want rental yield, go KL.

Anyway, Penang island will be seeing a large amount of Affordable Homes in the market thanks to the state’s initiative to provide sufficient “controlled” pricing properties into the market. It won’t be dirt cheap but definately cheaper ie. RM500 psf. @ tanjung tokong/bungah location with 2 cp and upgraded specs and partial furnish. However, I feel that this “supply” of affordable homes into the market can cause premiums in selected area to be sluggish. Example, I’m trying hard to sell my Jazz unit after hearing that IDEAL will be introducing 2,000+ units of affordable home in Seri Tanjung Pinang named i-Santorini soon. It will be averagely 450 – 500 psf. and Jazz current value is about RM900 psf may be affected adversely.

Just my two cent thoughts, sell off your property as soon as possible.

@Salahja

Property rental in Penang is between 3% to 4% pa which is true. However, when it comes to capital appreciation Seri Tanjung Pinang recorded the highest capital appreciation in Penang even in 2014.

Based on transacted record.

Quayside 1 bedroom 1137sf

Purchase date: July 2010

Resale date: September 2014

Holding years: 4 years

Purchase price: RM821,100

Transacted price: RM1,468,000

Total gains: RM646,900

% of profit: 78.78%

Average % gain per year: 19.7%

This transaction shows a 19.7% capital appreciation per year.

Even thought the price at Seri Tanjung Pinang is high but investors are still investing here as they can see the potential.

Only stupid people will buy at this price. It doesn’t end here but keep on paying

the high maintenance fee.

Hi Property 123 and salajah,

While the transaction is indeed true, it is important to note that past performance is not an indication of future performance. Furthermore, year 2010, 2011, 2012 are crazy for the property market in penang. It is too optimistic to expect the same performance. From end 2013 to today, Quayside appreciate about 4%/yr only.

However, no doubt, seri tanjung pinang is a prime area for investments.

Hi Stupid,

It is unfair to say people who buy at this price are stupid. It is however, people who are willing to spend at this price are those that can afford to spend. They are definitely wealthy and it is unfair to say that the wealthy are stupid. It may not make sense to you but that doesnt apply to others.

It is also important to note that those looking at Quayside and Andaman are comfortable enough to pay the high maintenance fee. I would say it is more likely that it is not a game for you.

True, that is why people are buying Ferrari and Lamborghini…

Price is ridiculous and maintenance is crazy…

But then again you have to ask them why they buy it…

Why people buy a Hermes bag for RM50K or why a Stefano Ricci shirt for thousands…

@Property 123

You must know how to differentiate the very “Rich” from the people that is

trying to be rich or “stupid” people. These rich people DO NOT live in these

cages of 1 bedroom of 1137 sf. built-up.

@Stupid, Property123

Haha…..I think this is the issue. If the RRP (recommended retail price) for that Hermes is 50k, and someone pays 50k for it, then it’s ok. But if someone pays 80k for it, then stupid lor. So, for that Quayside unit, the market price is around RM1000psf in resale market in 2014 with plenty of eager sellers at that price, but that guy actually paid RM1291psf. Not very stupid lar, but a little stupid lor. Then again, depends on furniture, reno etc. So just because you see a transaction at a certain price does not mean that everything is worth that much. That’s the mistake a lot of people made in the last 5 years, those who are still stuck and cannot flip.

@Buyer Hi Buyer… that’s a very good advise indeed… “don’t fall in love” Thank you and i mean it….

Thank you all for all your input. It’s very much appreciated. I’ll digest all these and probably will come back with some clarifications or advice. Planning a trip to the site this weekend to have a feel of things over there… Anything I should look at or look out for?

Salahja,

Get an agent and see a few units at quayside too, see if it is worth the premium to get andaman over quayside. lolz

I usually like to pay a visit to mgmt office to seek more information like, occupancy rates, common issues, vacent units etc.

For your case, check what other options are available and visit other projects too.

Happy hunting!

@Stupid

The rich don’t look at it from your point of view. The rich pays more to get higher returns and they do not buy CHEAP items.

Also if you understand purchasing habits, you will see things differently.

If you are driving a proton saga, the next car that you would buy most probably would be a Honda City or Toyota Vios – Reason to upgrade

If you are driving a Honda Accord or Toyota Camry, the next car that you would buy will be Mercedes or BMW – Reason to upgrade

If you are currently driving BMW or Mercedes, the next car that you would probably buy would be a Lexus or Porsche – Reason to upgrade

People always upgrade when they can, even though it is just a car with 4 wheels and will get you to the same destination.

Eample, Sungai Ara, Bayan Baru and Relau. Two and a half storey terrace was sold for RM500,000-RM600,000 exactly 10 years ago. However, it is now transacted at RM1,200,000.

This is great because it doubles up on capital appreciation but it took 10 year to double up and to get RM600,000. Yes you make money but remember it took 10 years.

Now look at the transacted recorded below, in 4 year the buyer made about the same amount. This is call smart investment because many people do not take time into consideration.

Quayside 1 bedroom 1137sf

Purchase date: July 2010

Resale date: September 2014

Holding years: 4 years

Purchase price: RM821,100

Transacted price: RM1,468,000

Total gains: RM646,900

However, I always tell my customers to invest based on their financial capability =D

@ko

Salahja already bought that Andaman. Due diligence should be done before purchase, not after.

Andaman purchasers are mostly Cartier type, pay high price for jewelery watches, but not bothered about resale value, whereas those who bought the surrounding areas are Rolex buyers, expensive, but value appreciation is also important to them. Who is richer? Can’t compare and not important. There’s no right or wrong either. Most important, let’s all keep the economy going! Haha…

i have a unit at Marina Bay condo. Letting go at RM670k. interested do let me know and i will revert back to you.

@Property 123

You are describing the “Stupid” people

not rich.

@Property 123

Isn’t that the appreciation need to reduce the amount pay to serve loan?

But anyway still a great increase in capital! Good job…..

@Property 123

Where on earth rich people need to drive Proton Saga and later upgrade to

Honda City or Toyota Vios ? Rich people don’t stay in these small cages of

1 bedroom of 1137sf. built-up. Only stupid people do.

Another question is how only define as rich??Honestly i saw multi millionaire driving a 8 years old toyota Vios…….

Tambun Royale City condominum at batu kawan mainland, is it worth to invest?

@IsaacTan

How do you know he is a multi- millionaire ?

Those rich ppl who earn money in the right way by themselves will spend money wisely, so mostly they will only buy those necessary things and invest in high appreciation things like land instead of this type of small cage which cost million. Those tycoon (土豪 type) who earn money in improper way (smuggling,scamming,gambling related n etc) or inherit lots of money usually they will spend money on luxury and more to enjoyment things. Some not rich but have to act rich like those direct sales (pyramid scheme type) also will do so.

I know a company founder in butterworth, he is driving kancil everyday. He told me that no point to show off and it will brings lot of unnecessary/unhappy things to u.

Another friend who have big durian farm in balik pulau also driving proton. Those people r more humble n low profile than what people mention here.rich guy drive big car n etc.lol

Hi Ketiak,

Salahja mentioned that his/her narrowed down to andaman 1 bedroom which I would believe is shortlisted.

There is always a reason for one to make a decision. What may seem wrong to others but is right to the decision maker. Nevertheless, ya i agree with you. Spend to keep the economy going. lolz… Please spend more.

That is your point of view. Salajah is a good example. Buy either to invest or for holiday stay. If for holiday stay, and if alone or with partner, need so many rooms? Every body has their needs /wants and spending power. It is not right for you to judge others. You find them stupid simply because you are in a different league.

Actually, there’s a difference between spending power vs being rich.

Last month, I sold 1 condo unit in Tanjung Bunga to a retired hong kong couple for 1.1 mil . There don’t consider themselves rich people back in hong kong as they were only average gov servants.

Last year, they sold off their tiny apartment in hong kong for RM4mil because they were coming to live in Penang under MM2H. After many years in gov service, the withdrew their pension recently for a total of RM3mil (RM1.5mil each I guess). So after buying the apartment from me, they still have about RM6mil left for their retirement in Penang. Again, they are not rich people, they don’t consider themselves rich, but they have high purchasing power in Msia. E&O is targeting this type of people. They don’t have to be rich, but we are just too poor here. Haha!

@ko

You are promoting and I can’t judge others ?

@Stupid

He is my uncle and i know how many houses & warehouse he had that paid by cash.

Not only that, he also just sharing the Toyota Vios with his son and thats the only car the family has.

@IsaacTan

But you never knew I know your uncle.

@Stupid

Really…..Lol

Yesterday there was a young man killed (shot at point blank range) by a triad member in Bukit Mertajam. Not news, it’s quite common and BM and Raja Uda. So be wise when you choose where you live in mainland.

@titty

The next one going to get shot will be you. So, be wise when you speak belittle and run down mainland. Be careful when you ever come to mainland like BM and Raja Uda.

@titty

So don’t buy at mainland. It’s that simple.

@Property 123

Agreed…

@slitty

You are so negative, and you must be not a rich people but just someone who always complain.

@slitty

You are so negative, and you must be not a rich people but just someone who always complain.

You are so negative, and you must be not a rich people but just someone who always complain.

@Property 123

Agreed…

You did not have data of proof for your quote. In fact, my Uncle owned chain stores and drive Merz but his whole family is staying in Air Itam landed. You might not familiar the place and you can take a round of the area. You will found out a lot of hidden dragons…

Hi guys need your opinion.what about buying a property in pearl city simpang ampat?or batu kawan would be better?tq

Batu Kawan – Landed leasehold min 900k

Pearl City Simpang Ampat – Landed freehold min 490k

Half of the price, half of the burden, 10km radius. I will go for Simpang Ampat for sure.