RM2.94bil worth of properties will be launched in Penang this year

GEORGE TOWN: Some RM2.94bil worth of residential and commercial properties from six developers, based in Kuala Lumpur and Penang, will be launched on the island this year.

The south and south-west of the island will see some 1,275 units of residential and commercial properties launched with an estimated gross sales value (GSV) of RM1.45bil, while the north-east district will see the development of about 1,166 units of properties valued at RM1.49bil.

The commercial component in the south and south-west district is about 156 units with a GSV of RM221mil.

In the north-east, the commercial component will comprise 308 units of serviced suites and shop lots with a gross sales value of RM160mil.

Mah Sing Group Bhd, IJM Land Bhd, SP Setia Bhd, Ideal Property Development Sdn Bhd and Wabina Holdings Sdn Bhd are some of the developers that have drawn up plans for new launches this year.

In the south-west, Penang-based Ideal Property Development Sdn Bhd is launching the most projects this year with a combined estimated gross sales value of RM793mil.

Its projects in Bayan Lepas include the RM295mil Fiera Vista, comprising 470-unit condominiums;the RM250mil Valencia Park bungalow scheme, comprising 142 detached houses; and the RM248mil Taipan, a mixed development project comprising 75 shop lots (GSV RM149mil) and 75 semi-detached houses (GSV RM99mil).

“Both Fiera Vista and Valencia Park will be launched in July or August, while the Taipan will be launched in October,” Ideal Property managing director Datuk Alex Ooi said.

IJM Land is launching in June the RM300mil Light Collection III, comprising 150-unit condominiums next to the Penang Bridge, and the RM113mil The Address in Bukit Jambul comprising 148 low and high-rise condominiums in September.

For the commercial market, IJM Land is launching in the second half of 2011 the RM72mil Pearl Regency, comprising 81 retail lots, for its Metro-East mixed development scheme, near the Penang Bridge.

SP Setia Bhd’s key project in the south-west district this year is the RM120mil Pearl Villas, comprising 35 bungalows, to be launched in April.

Wabina Holdings Sdn Bhd is introducing the first high-end condominium scheme, the RM50mil Pavilion Tower, comprising 99 condominiums in Teluk Kumbar, south-west district of the island.

In the north-east district, Mah Sing is undertaking the development of the Icon Residence at Burma Road and Batu Ferringhi Residence in Batu Ferringhi, which have a combined GSV of over RM1bil.

The group’s spokesman said the RM280mil Icon Residence, comprising 280-unit condominiums with built-up areas ranging from 1,400 sq ft to 2,500 sq ft, would be unveiled in the second half of 2011.

The units are tentatively priced from RM770,000.

At the same time, the group will also introduce the RM800mil Batu Ferringhi Residence, which will comprise over 500 semi-detached houses and bungalows.

“There will also be condominiums with built-up areas of between 850 sq ft and 1,800 sq ft, priced from RM468,800,” he said.

SP Setia Property (North) general manager S. Rajoo said the group would launch the RM65mil Brooks Residences, comprising 11 bungalows, and the RM188mil Setia V Residence, comprising 67 units, in Kelawei Road, near Gurney Drive.

The projects would be launched respectively in July and September.

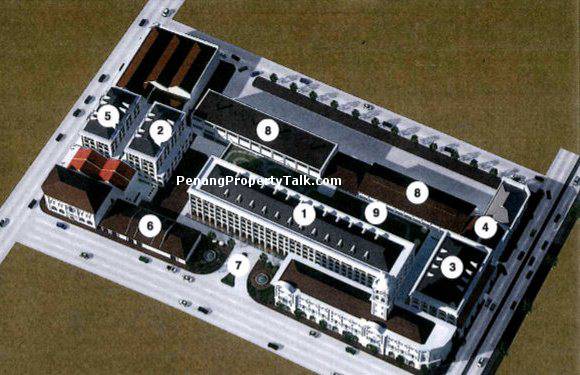

IJM Land is expected to launch the RM160mil Maritimes project, a commercial scheme which will comprise 240 serviced suites and 68 shop-lots.

SOURCE: The Star