How safe are G&G communities?

The oldest and strongest emotion of mankind is fear’. – H.P. Lovecraft

The oldest and strongest emotion of mankind is fear’. – H.P. Lovecraft

MUCH has been written recently on the mushrooming of gated and guarded (G&G) developments in Malaysia. Many of these developments have been the result of the steadily deteriorating state of security in our communities with regular reports of break-ins, kidnappings, rape and other acts of violence being highlighted daily in the newspapers and media. Our fear of this is nothing new except that the scale of it has magnified in the last 10 years.

When I look back, the first thing we did when we bought a house in the 1970s was to have it fitted with grills – for the doors, windows and any aperture that could give access to a criminal. We are used to living in virtual prisons, but these grills gave residents a sense of security.

Communities started to expand with the influx of foreign workers, both legal and illegal. Inevitably, these barriers presented no problems to a new wave of criminals who displayed much innovation in their approach to gain illegal access and entering homes. Crime had arrived big time on our doorsteps, and we were fearful.

These security concerns gave rise to the first of the G&G communities; some of the earliest examples which were Country Heights in Kajang, Tropicana in Petaling Jaya, the Mines in Seri Kembangan and Kelab Golf Sultan Abdul Aziz Shah in Kuala Lumpur. These early developments included golf courses, club houses and other amenities.

Condominium developments featured the G&G concept and became popular because they offered the same level of security. The popularity of the developments in Mont Kiara, Bangsar and Ampang in Kuala Lumpur is self-evident as they were well taken up by the expatriate community and wealthy members of our community. Developers seeing this as an excellent way of positioning their products for premium pricing started launching G&G housing and condominium projects on a larger scale.

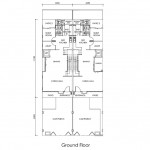

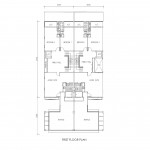

These G&G developments come with perimeter fencing, a single ingress and egress point at the security guardhouse, 24/7 patrol guards, CCTV (close circuit television) systems (some even offering motion detectors) and a smart home relay system to the guardhouse to monitor visitors and to provide security feedback.

Within homes, there could be a Smart Home system installed, apart from the regular home alarm. There is another point in the Smart Home relay system that is linked to the guardhouse, which allows security feedback and monitoring of movement within the G&G community.

And, they were expensive to buy and live in. Estimates show that a G&G home can fetch as much as a 60% premium over regular homes. However, these are landed strata developments and as a result, all the amenities are owned by the residents and they have to pay a monthly maintenance fee and sinking fund as well as set up their own Management Corporation to manage the community after the developer hands over the development to the buyers.

Sometimes these fees can amount to as much as RM600 to RM1,000 a month.

Problems arise when some residents don’t pay up (some could be foreign investors who can’t be contacted) and so the residents living there have to pay more to maintain the level of service they require. With this price tag comes peace of mind as these G&G developments have a lower crime rate when compared to older developments that don’t have it.

Well, that takes care of the rich and famous but what about the rest of us Malaysians?

G&G developments account for a fraction of the 6.4 million households in Malaysia and many have to live with the daily fear I have described. Some communities have taken things into their own hands and this has resulted in makeshift arrangements like the pooling of resources to have a guard at the end of the road to register visitors who are coming in and leaving, or paying a company which promises to do patrolling services in the neighbourhood.

These services can cost as much as RM40 to RM200 a month with varying results.

It is not possible for the entire population of Malaysia to live in walled communities. What we need to do is tackle the problem at the source. In short, we need more “boots” on the ground from our police force, more patrol cars, increased lockups and more community police stations. However, the Government does not seem to have the budget to do this – but the local councils do.

If households can afford to spend up to RM40 a month for an old guy on a motorbike to patrol their neighbourhood, shouldn’t we instead, pay that amount to the local authority to improve the security in our towns and cities?

The provision of our security has always been the job of the Government of the day, and they are mandated to provide and pay for the personnel as well as the infrastructure (patrol cars, offices, police stations and accommodation).

What if it was the responsibility of each town or city to pay for the infrastructure and the Government only pays for the cost of the personnel? I honestly think that this could work.

Two things will happen. Each town will have a better paid and fully equipped police force with state-of-the-art facilities and the Government will be able to dispatch more police to control crimes.

Local authorities will have to ask resident owners to pay a “Security Assessment Levy”, which will be added to their current assessment payments that could be passed on to tenants (if the property is rented). I know that there will be howls of protest but aren’t these same people willing to pay anywhere from RM500 to RM12,000 a year for a sense of security?

A friend of mine who lives in a G&G community shared with me that his friends have stopped coming around because of the hassle of visiting him and he feels isolated from the suburb he lives in. He worries about his kids leaving the house to play with his friends outside his G&G haven and his wife is constantly on the lookout for snatch thieves. Living in a G&G community does not preclude one from potential criminal acts as it can easily happen outside the home.

The answer lies in providing us with better security and a better funded police force. We must start to find a formula that will work in the long run. Locking ourselves in is never a solution as it treats the symptoms but not the disease which, if not checked, could paralyse our society over time.

Source: StarProperty.my

HBA is happy that more affordable homes are to be built under Budget 2015 and DIBS ban stays.

HBA is happy that more affordable homes are to be built under Budget 2015 and DIBS ban stays.