Penang Property Outlook 2015

by Ken Lim

by Ken Lim

Property prices in Penang have been on the upward trend for the last seven years. However, the scale of growth in 2013 & 2014 has considerably slowed down as expected due to the cooling measures adopted by government and Bank Negara.

As we enter a brand new year in less than a week, growth is expected to progress at a slower rate in first half of the year against the backdrop of present cooling measures and the uncertainty in the property market. This does not mean that we are going to see a visible reduction in property value. Instead we shall see a better growth in second half of the year after all the cooling measures have been normalized and the doubts on GST issue are cleared.

Market Trends

The number of residential property transactions has been declining since 2011, mainly due to the slowdown of sales in the primary market. In 2013, the number of transactions in the primary market has dropped from its peak of 13,735 at 2011 down to an astonishingly low value of 2,750 in 2013, which is only 16% of total residential property transactions in Penang. The number has not improved much in 2014.

The continuous decline of sales in the primary market is mainly due to the fact that the average selling price is approaching the psychological upper limit of RM600k. This is the price which is generally considered affordable for young married knowledge workers in Penang however the cooling measure adopted by Bank Negara Malaysia are making it harder for these young couples to get the necessary amount of loan.

The downtrend in sales will force developers to seek alternative effective approach in their pricing strategy. In order to secure a respectable degree of interest from the home buyers, developers are likely to adopt a more conservative pricing strategy. Instead of positioning their projects based on price per square feet, the strategy will focus on the final selling price of the property, which falls within the range of RM500 – RM800k depending on areas. As the housing price continues to appreciate, people are now more receptive to a smaller unit as long as the price is within their reach of affordability.

On the other hand, secondary market remains very active with only a slight decrease in transactions over the past few years. This indicates that overall consumer confidence is still strong as many are searching for good buys in the secondary market within their purchasing capability. In fact, 2015 is still very much considered a buyer’s market and it is good time to hunt for one.

Affordable Housing

Housing affordability has been a hot topic in recent years. The heat continues to escalate in 2014. While both government and private sectors have formulated various plans to deliver affordable housing, there seems to be a constraint in the marketing effort from the government in elevating the level of awareness to the people. Although there are more than fifty one thousand applicants applying for government housing projects, only around 10% of them applied for projects with respect to the offering of affordable units (RM200,000 – RM400,000). This is way below the 13,851 affordable units planned by the government.

Affordable housing is going to be the primary theme in the local housing industry in 2015. As of today, a lot of affordable housing projects have been planned by government and private sectors however very few have actually commenced operations. It is therefore expected to observe a higher level of marketing activities and a greater degree of execution in affordable housing projects in 2015.

Mainland Penang

The landed properties in Mainland have appreciated significantly in the past few years. Seberang Perai Tengah area has benefited the most due to its strategic location, being in the centre of the two Penang bridges. Most of the new landed projects are now fetching a price of more than RM500k. A majority of the new 3-storey semi-detached prices exceeds more than RM1 million now. The price is believed to escalate to the next level as more major property players such as EcoWorld are expected to launch their new projects in the mainland in 2015.

When affordable housing started to flourish, it may be a challenging time for the condominium sector in the mainland as they will be competing within the same pricing range category with the affordable units in the island.

Today, as the concept of lifestyle gains momentum, gated and guarded housing projects in the mainland continues to be an attractive option as some of them still fall within RM500k-600k pricing bracket. There are also more choices of well-planned township due to the availability of large land bank in the mainland.

What about Batu Kawan?

Batu Kawan is a growing brand in the making. There may be some development going on however it is going to take many more years for it to develop into a full fledge township. Not much excitement is expected in 2015 except for some growing interest in the affordable housing project as well as the first phase of Aspen Vision City, driven by Aspen Group. If everything develops according to the initial proposed plan, the construction of an integrated shopping mall anchored by IKEA is expected to starts by the end of 2015. We can also expect some updates on the mixed development project by EcoWorld and the premium outlet mall.

Statistics of 1.2 million visits in PenangPropertyTalk.com in the current year of 2014 have formed the basis of my analysis and thinking process regarding this subject. However it is my firm belief that the critical and unbiased assessment shared in this article drives towards a possible pattern as we usher the beginning of a brand new year.

(Written on 28 Dec 2014)

– Ken Lim

(Founder and Principal Reviewer, PenangPropertyTalk.com)

*Article refined by Alex Tan (Writer at www.bokhooi.com)

With the various property cooling measures in place, the market has inevitably stabilised. Property speculation has been slowed down tremendously.

With the various property cooling measures in place, the market has inevitably stabilised. Property speculation has been slowed down tremendously.

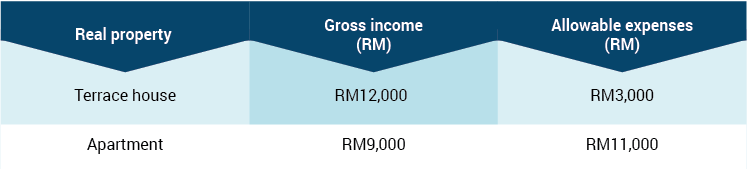

The secondary property market in the country has good potential as the prices of the houses could be 30-40 per cent lower than the new ones, said the Malaysia Institute of Estate Agents (MIEA).

The secondary property market in the country has good potential as the prices of the houses could be 30-40 per cent lower than the new ones, said the Malaysia Institute of Estate Agents (MIEA).