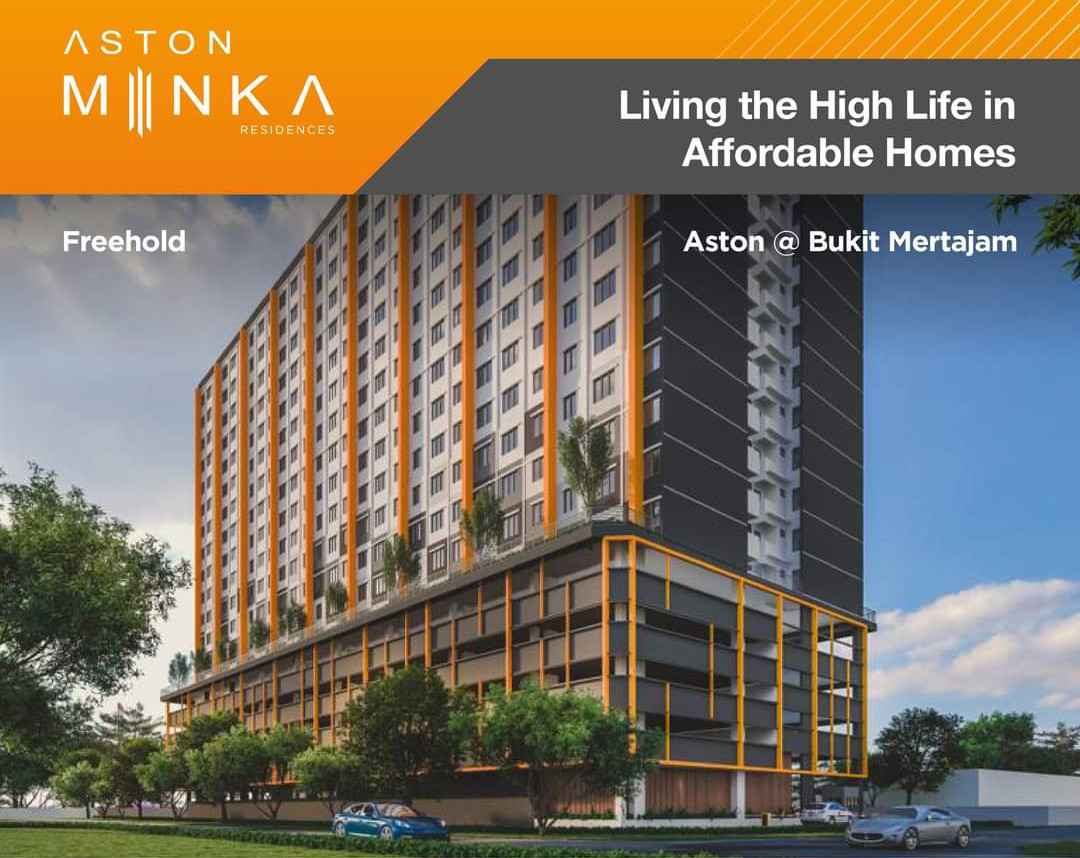

Aston Minka Residences

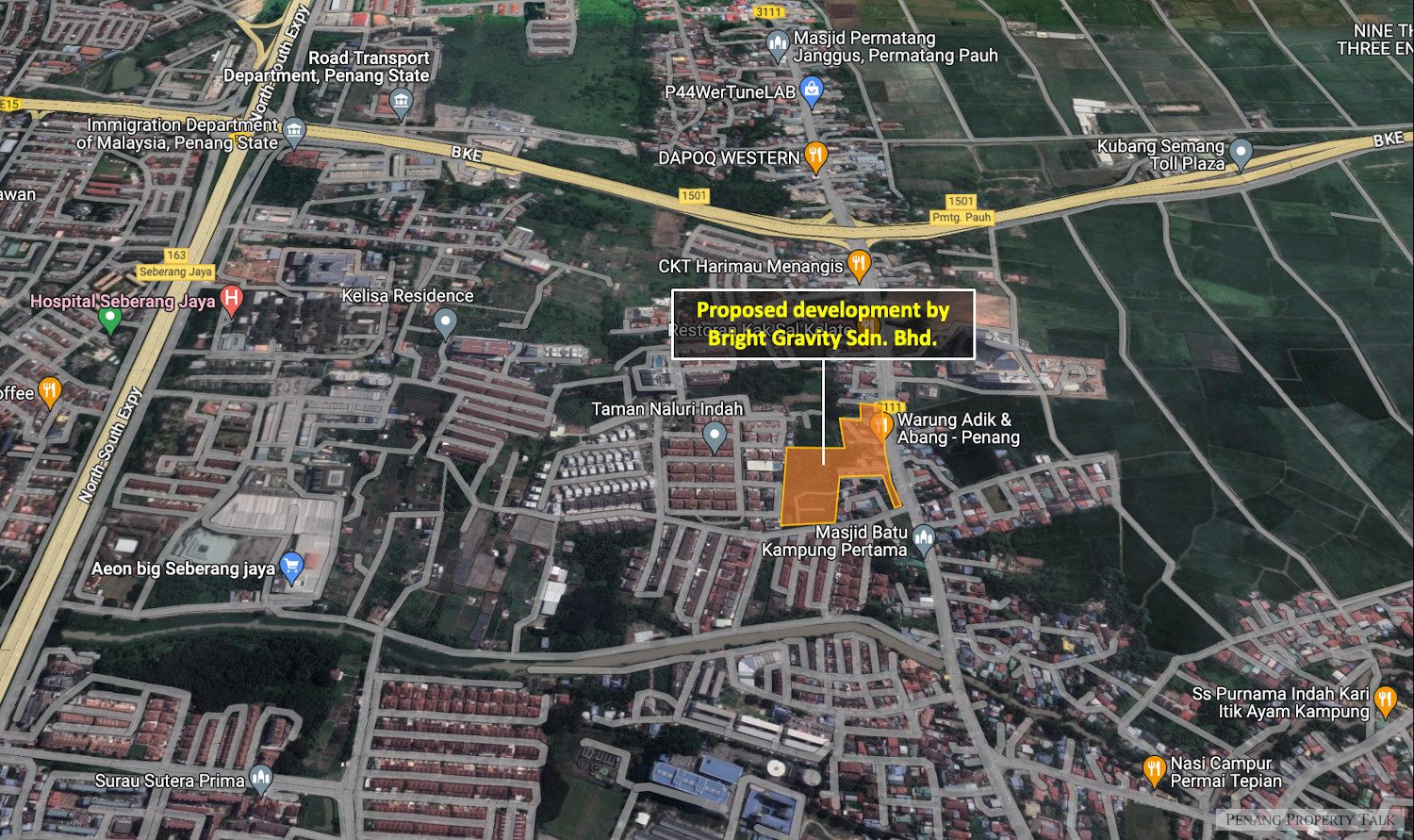

Aston Minka Residences, an affordable housing development by KH Venture Estate Sdn. Bhd. (Jayamas Property) in the heart of Bukit Mertajam. Located on a 1.29-acre land along Lebuh Aston, immediately opposite Aston Park East gated and guarded housing scheme. It is just a stone’s throw away from Jit Sin Independent High School, surrounded by an abundance of essential amenities.

This development comprises a 18-storey residential tower, featuring 237 affordable units and 4 levels of car parking podium. Residence facilities will be located at level 5.

READ MORE ABOUT AFFORDABLE HOUSING:

- Eligibility and the requirement of buying affordable housing

- Full list of affordable housing in Penang

Project Name : Aston Minka Residences

Location : Bukit Mertajam

Property Type : Affordable housing

Built-up Size: 950 sq.ft.

Total Units: 237

Indicative Price: RM250,000 onwards

Developer : KH Venture Estate Sdn. Bhd. (Jayamas Property)

Subscribe here for updates on this project and other property news

DISCLAIMER: This article is solely based on research done using publicly available data. This is not an advertisement. Any claim, statistic, quote or other representation about a project or service should be verified with the developer, provider or party in question.