Property Crowdfunding Explained – First home buyer

Want to know more about the peer-to-peer home financing scheme announced in Budget 2019?

By using FundMyHome scheme as an example, here we have extracted the summaries of key points by Malay Mail below:

What is it in a nutshell?

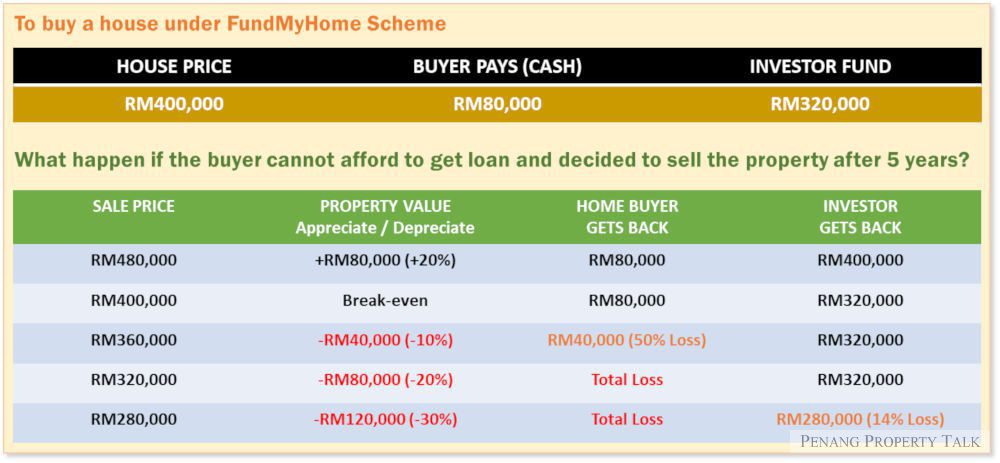

Quite simply, FundMyHome allows a person to buy a home by paying an upfront 20%of the house’s price, with investors such as banks committing to fund the remaining 80% in exchange for a share in future profits.

Under the scheme, the buyer does not have to make any monthly payments — unlike a housing loan — for five years. After the five years is up, the buyer can choose to take up a housing loan to buy the property or sell it off to make some profit. This is assuming the property has appreciated in value.

Do you qualify?

First up, you have to be a Malaysian aged above 18 years who is not bankrupt and who is a first-time homebuyer. You can even buy a house together with another person who is also buying a house for the first time.

The scheme is not for those who just want to make quick profits or for those who don’t plan to own the home for a minimum of five years.

How does it work exactly?

First, a buyer will have to pay a 2% booking fee to reserve a unit in the housing projects listed on FundMyHome’s portal, with the reservation on a first-come-first-served basis.

Houses offered on FundMyHome fall into two categories: “Fully Funded” and “Funding in Progress”, with those in the former category requiring the buyer to pay the 20% and all fees to FundMyHome within at least 14 days.

As for the “Funding in Progress” category, the buyer will again have 14 days to make the same payments, if funding from investors that are typically banks meet the funding target of 80% of the house price within 30 days.

But all funds will be refunded without interest if the funding target is not met within the one-month period.

If all goes well, the legal process for the home purchase from the developers will then take an estimated two to three weeks, according to the FundMyHome portal.

The ownership arrangements, according to FundMyHome’s terms and conditions, is that the buyer becomes a property owner after entering into a sales and purchase agreement (SPA) with the developer, and after other agreements are made.

Rights and obligations

You as a homebuyer under the FundMyHome scheme have become the legal owner of the property. Here’s what you can now do besides staying in the property: Rent the property out until the fifth year of the purchase subject to FundMyHome’s terms and conditions; or renovate the house using your own money subject to the property development’s house rules.

But you will also, as a homeowner, have to pay for all related fees such as management fees, quit rent, assessment tax, insurance, repairs and maintenance costs.

What happens after five years?

The catch is that the house cannot be sold during the five-year period, with the buyer and banks also barred from exiting the scheme during this lock-in period.

About four years and three months from the date of purchase, FundMyHome will appoint an independent and qualified valuer, with the buyer then given two months to arrange for the property’s inspection by the valuer.

FundMyHome requires buyers to have the valuation completed six months before the end of the lock-in period at the buyers’ own cost.

At the end of the five years, the buyer will then have two options: To keep or sell the property.

OPTION 1: Stay on

The buyer can choose to be in the FundMyHome scheme for another five years, with the condition that the buyer tops up with additional money to fulfill the 20% portion if the property’s value has gone up.

As for investors such as banks, they can choose to stay on or sell their 80% share to other institutions. The buyer can alternatively use his/her own money or take out a bank loan to buy off the 80% share from the investors.

OPTION 2: Sell

If the buyer chooses to sell the property, he/she has to leave the property and hand it over by the end of the fifth year, or pay rental based on a 5% rental yield. The property will be advertised for at least three months, with FundMyHome cautioning that it is not guaranteed that the sale process will not be longer than the usual three to six months.

The homeowner will have to bear all third-party costs related to the sale, with the property sold to include developer-provided furniture and fittings in good condition subject to the usual wear-and-tear, while buyer-purchased furniture and fittings can be excluded.

And the catch?

The biggest downside would be the risk of the property depreciating in value at the end of five years, with FundMyHome noting that they could lose some or even all of their capital if the property price falls.

When the property is sold after the fifth year, the order of priority for the distribution of sales proceeds is: Investors or bank to receive their original capital first (80% of purchase price), buyer to receive buyer’s original capital (20% of purchase price).

As for the order of priority for the profits after the original capital is paid out, the investor receives a preferential share of the capital gain or profits (equivalent to 20 per cent of purchase price), while the remaining capital gain will be split to the investor at 80% and the buyer at 20%.

FundMyHome provided an example based on an initial house price of RM300,000 where the buyer pays RM60,000 (20%) and the investor or bank pays RM240,000 (80%), with scenarios of the property value either going up, remaining the same or going down at the end of the five-year lock-in period.

The table below will illustrate how the calculation works:

Don’t forget the new tax rate

Note: If for some reason, you decide at the end of the five-year period to sell the property instead of continuing to own it, there will no longer be zero tax on your profits from the sale.

In the recent Budget 2019 speech, the government said it will now impose a 5% Real Property Gains Tax (RPGT) on profits from the sale of properties that were purchased more than five years ago, unless the property is valued at below RM200,000.

There may be another crowdfunding platform in the future. You just have to read the terms and understand your risks.

*Regulations for the property crowdfunding framework that is expected to take effect in the first quarter of 2019*

Source: Malay Mail

Note: As stated in Malay Mail, this story is based on the latest available information on the FundMyHome portal as of the time of writing, and is not meant to be an exhaustive list of information on the terms and conditions of the FundMyHome scheme. You may read the full article from the link above.