How GST Will Impact Home Prices & The Property Market

WITH the coming implementation of Goods & Service Tax (GST) in April 2015, many Malaysians are concerned with what this bodes for prices in general. It is inevitable that home prices will also be affected. In this article, we explain how home and property prices will be affected moving forward.

To properly appreciate how GST will affect home prices, it is necessary to first understand how GST works. (Click here for a detailed but simple-to-understand explanation of how GST in Malaysia works).

Aside from GST, one must also have an understanding of the Sales Tax, which is the existing tax scheme affecting the property sector. GST will supplant the Sales Tax come April 2015.

Tax Scheme on Residential Property – The Similarities

In comparing both tax schemes, we have to first identify their similarities.

One similarity between GST and the existing Sales Tax scheme is that no taxes are charged or will be charged to the consumer on the purchase of a home / residential property. For GST, residential properties fall under the “Exempt Rated” basket of goods.(But do take note that GST will be charged to the consumer for commercial property purchases as commercial properties are “Standard Rated”).

However, during the creation of the final product (also known as the input stage in tax parlance), under both tax schemes, developers would incur taxes during procurement of their inputs and materials. And this is where the differences start to become apparent between both tax schemes. The tax rate for inputs and materials vary between GST and Sales Tax.

Sales Tax VS GST for Residential Properties – The Differences

Based on the Sales Tax Act of 1972, basic building materials such as bricks, cement and floor tiles fall inside First Schedule Goods, in which all the goods in this category will not be subjected to sales tax. Meanwhile, other building materials fall inside Second Schedule Goods, in which all the goods in this category will only be charged sales tax of 5%.

Under the new GST implementation, all building materials and services (E.g. Contractors, engineers) will be subject to GST with a standard rate of 6%. This will invariably raise the production cost for developers.

If you understand how GST works, you will notice that in most cases, the additional tax cost is simply passed on to the final consumer (Standard-Rated goods), or is claimed back from the government (Zero-Rated goods). But in this case (Exempt-Rated), the additional tax cost is borne by the party before the final consumer – The developer.

The developer does not have a next “victim” in the supply chain.

This seems like good news for home buyers as they do not have to pay GST when purchasing a home. However, one should not be too happy about this. It is no stretch of the imagination to think that developers would try to build in the additional tax costs into the final sale price implicitly.

Before & After GST – A Comparison

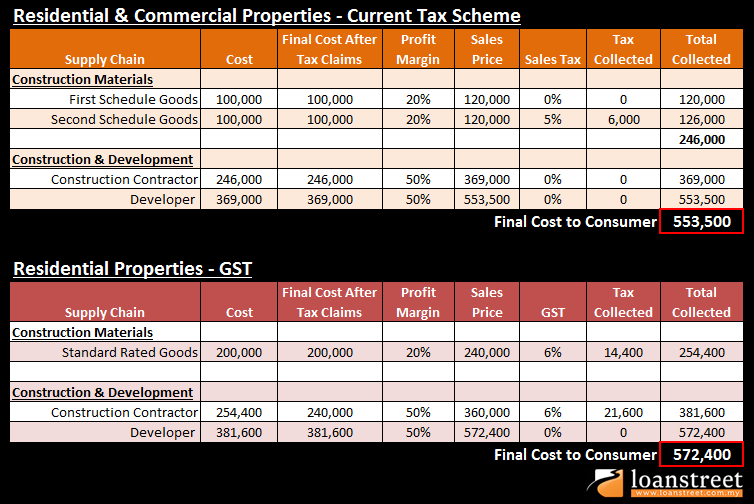

The tables below show a comparison between the cost of a new property before and after GST. Certain taxes and costs leading up to the sale to the final consumer have been simplified for this purpose.

Also, an assumption is made that developers are able to transfer 100% of all incurred tax costs over to the consumer via the sale price.

The example above shows a price increase of 3.41% for new residential properties post-GST implementation. But there is a plus point to this.

Overall, new residential properties may register a lower overall increase in tax burden compared to Commercial Properties that are Standard-Rated. This is because there still is the chance that developers may only transfer some and not all of their tax cost increases into the final retail price.

The downside to this is that where pricing for new commercial properties will be cleaner (Sales Price + GST), pricing for new residential homes would look inflated. This, in turn, will undoubtedly have a knock on effect on prices in the secondary house market.

Conclusion

As a home buyer, it pays to know what the implementation of GST might bode for home prices moving forward. If you skipped the entire article, here are all the key insights in a nutshell:

1) With GST, there should be a once-off increase in property prices across the board

2) While developers may not bill home buyers for GST, they could transfer the costs implicitly via the sale price

3) The overall price increase for new residential properties could be marginally lower than that for new commercial properties

4) The secondary home market should see a knock on effect in prices

Armed with this knowledge, you can make a better decision on when to purchase your home.

Source: StarProperty.my

ok. house price will shoot up after GST.. lai ..lai ..lai..sapu the property now!

Apa ni, now Singapore Property experience shrinkage, not bubble. The Sg Finance Minister foresee the property price is going to drop further on the next few quarters. Probably would max up to 20~30%. But the deal is still good, earn less and not at loss.

So 2nd home market will increase as well o wat?

Time to buy before GST….or just suffer with higher price later

I already sapu b4 GST… Just in case…

RM 553,500 vs RM 572,400? So little difference only ah? I bought Bayswater RM350,000 last time, now it’s RM 900,000. That’s what I call difference. Hahahaha.

I see a lot of “property victims” lying all over the floor, half daed, and dunno which way is to the hospital, just waiting.

oh by the way, for those who are renting out their residential as hostels, vacation rentals (and other commercial usage), watch out. The authorities are going to clamp down on that soon.

Good news for Soho owners though. They will get a lot of business from short term rentals and hostels. All banglas will be moving to these sohos. Can operate bangla sundry shops selling veges and poultry from the soho unit.

So if anyone is thinking about buying a property just to mitigate the risk of price increase due to GST, think twice, if you can wait. Havoc is coming. Let the dust settle first.

“4) The secondary home market should see a knock on effect in prices”

sorry my England is bad…..this sentence means secondary market price will shoot up, or go down?

@joe

“knock on” could mean either way, but it’s kind of like a one-off effect. But i guess the writer should mean “up” rather than “down”, as property companies are big advertisers of TheStar. They wouldn’t want to rub salt to the wound during this turbulant times.

@marine

sounded like an expert wow….then can you tell when the price will drop? and the drop is how much?

@marine

Very informative. Thanks for sharing…

For Residential Properties -GST, why construction contractor price reduce for “Final Cost After Tax Claim”?

@IsaacTan

Because the 6% has been “transferred” to the final selling price of the contractor, otherwise there would have been a double-taxation.

@marine

Thanks Marine….Actually RM20k compare to the price of house, is not that much.

Don’t really think people will rush to go in at this time just to save the RM20k.

What do you think?

the example is with calculated profit margin of 20 & 50%…..what if they demand a 40 & 100% profit…..sure the hike is not 20k rite……

@joe

You are right. They can ask for a 100% profit, 200% profit or 1000% profit. It is TOTALLY NOT GST related. Don’t get rushed in unnecessarily by the misconceived “GST-effect”.

However, based on the current market condition, the “asking” profit % would have more probability to go down rather than up. In the end, GST is just some noise, the dominant factor is still the market sentiment.

Actually not much defferent, but developer will sell at higher price and tell u due to GST, GST only give chance to developer suck more buyer blood, then subsale also follow tag with new project price.

@==

It depends on market condition. The market has been oversupplied with unoccupied homes. Rental rates are dirt low. Flippers are having problems flipping, not that they are going to jump off the building tomorrow, but they are starting to get worried, which is not good for sentiment.

@marine

“they are starting to get worried very worried” ???? Nothing to worry.

Those who keep on waiting will worry more and are coming up with

ridiculous assumptions !!!!!!

@Mainland

Means the property market price will still grow healthily?

@IsaacTan

Those who keep hoping and waiting for price to drop are those should be

worried. The point is those who bought earlier already make a decent profits

and these people are just “cry father and cry mother” only !!!!!

30% of unoccupied house belong to foreigners. Vacation house for them to stay during their winter / holiday time. Actually go and check the data how many house purchased by foreigners / non “penang lang”, then it will decide if properties market will be impacted. These are the people with holding power. In flow of investment into Penang. Only short investors will be impacted. Furthermore RM currency after conversion really doesn’t impact oversea investors. Unless gov implement cooling measurement for foreign investor. Other than that no much impact to Penang properties.

Actually GST will reduce house price because household no more money to spend and thus no money to buy expensive house. Price of property will come down to reflect the household budget.

30% foreigner in Penang? Not that many. Probably 5% and they can only buy 1Mil condo.

And we can see almost 50% of condo is vacant. Most property in Penang island is in distress. Cannot find buyer.

Am I consider a foreigner to Penang when I’m from other states in Malaysia? But in Malaysia statistics we are consider local as long as we hold Malaysia NRIC. This is a wrong statistics information from my point of view. I one of the many purchased property in Penang as my vacation home so are my friends and we just go to Penang for holiday and Condo is the best option for us. I don’t think we will rent it and is not a concern if it is vacant. So this contribute some figure into 50% condo is vacant. So many in tanjung tokong owned by Indonesians and leave it empty for their family vacation home.

@testmenow

You mean those properties in southern part of island? Yeah, mostly are local buyers. You will see more and more units coming into the market very very soon.

Now not only GST impacting. Interest rate increase also adding load to citizen.

But our good Gov still keep saving no significant impact!