What Malaysians want for Housing in Budget 2018

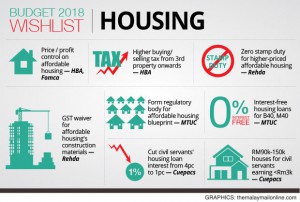

Warning of a “homeless generation” of Malaysians who cannot afford to own homes, the National House Buyers Association (HBA) mooted four mechanisms to avert such a crisis, including curbing property speculation through higher stamp duty rates and higher real property gains tax on buyers and sellers who own more than two properties.

Warning of a “homeless generation” of Malaysians who cannot afford to own homes, the National House Buyers Association (HBA) mooted four mechanisms to avert such a crisis, including curbing property speculation through higher stamp duty rates and higher real property gains tax on buyers and sellers who own more than two properties.

HBA said the government should increase the supply of affordable homes by incentivising private developers with fast-track project approvals, cheaper land conversion or alienation costs, partial tax exemption on profits from such projects.

It also mooted a nationwide rent-to-own scheme for the B40 and M40 group to help them overcome the usual 10 per cent deposit hurdle; it also urged the government to intervene by imposing price controls on affordable housing as it knew the actual land costs developers had to bear.

The Real Estate and Housing Developers Association (Rehda) proposed measures to make it easier for first-time buyers of affordable homes, including full stamp duty exemption on higher-value affordable properties instead of the RM300,000 limit announced in the last Budget, as well as exemption from higher conveyancing legal fee rates —— newly introduced this March —— for such properties.

Rehda’s detailed 10-point list also suggested waiving the Goods and Services Tax (GST) on affordable housing construction materials, and allowing first-time homebuyers earning below RM10,000 to have the housing loan interest during the construction period to be included in their affordable housing unit’s price.

Besides asking for lower business costs, Rehda also said the minimum RM1 million price limit announced in Budget 2014 for foreign buyers of residential properties should be replaced with a three-tier pricing system according to how urbanised a state is.

Source: The Malay Mail Online

1% interest, loan 700k, monthly installment only 2.2k

“HBA said the government should increase the supply of affordable homes by incentivising private developers with fast-track project approvals, cheaper land conversion or alienation costs, partial tax exemption on profits from such projects.”

I fully agree with this. with rising land costs and materials affordable housing is not lucrative for developers to build. In order to spur more affordable housing incentives such as those suggested must be in place. This must also include minimum contributions for various departments, and low development charges.

@Michelle

Don’t waste your time lah, incentivising developers will only lead to developers building more houses that are not needed. Just look around, have you not realised the number of empty homes? Just do one thing, impose a heavy tax on these empty homes (say 20k a year) for as long as they are not occupied. That will de-incentivise rich people from buying and hoarding homes. I guarantee you that property prices will drop another 20-30% in a month’s time. That’s how you make housing affordable.