Latest about Penang Airport and pending approvals for PSR and PTMP

Building an airport on one of Penang’s three man-made islands off the southern coast of the state will keep the airport within the state, Chow Kon Yeow said.

The Penang chief minister said the administration wanted to keep the airport on the island instead of moving it elsewhere.

“It is needed in Seberang Perai or elsewhere, it is a fact we have to accept since we do not have any more lands in Penang island which is why we came up with proposal to build it on one of the reclaimed islands,” he said in a press conference today after attending the launch of a gender equality policy programme.

He said the current Penang International Airport (PIA) has constraints when it comes to expansion plans for it.

“The terminal capacity can be expanded to cater to 16 million passengers, even up to 20 million passengers but can the runway cope with this load?” he asked.

He said it was impossible to expand the runway as there were not enough lands at the existing airport unless they relocate factories nearby.

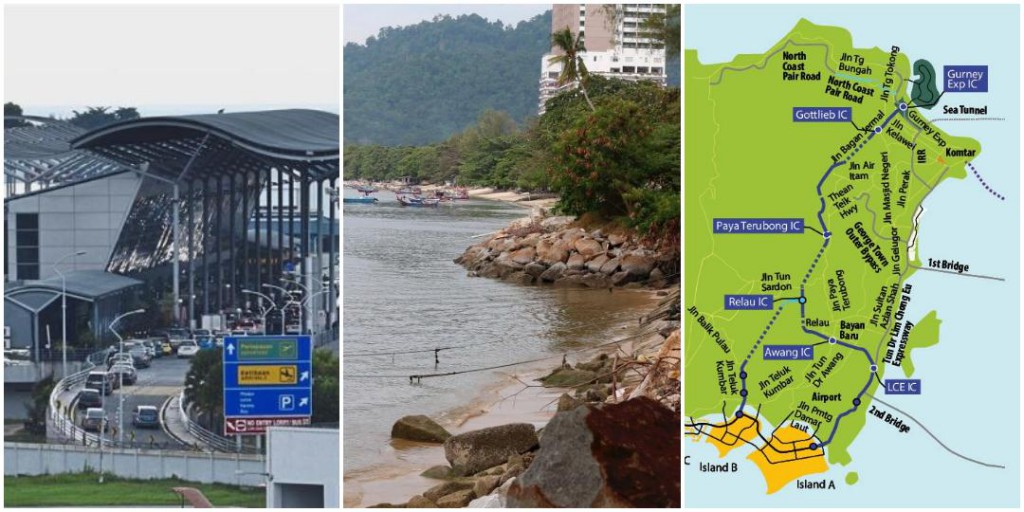

“That is why in the long run, we are looking at a new airport on one of the PSR islands,” he said, referring to the Penang South Reclamation (PSR) project.

The PSR was to create three man-made islands off Permatang Damar Laut on the southern coast of the main island.

It is the funding module for the state’s proposed RM46 billion Penang Transport Master Plan (PTMP).

Chow said the state has already engaged with consultants to draw up terms of reference and scope of studies for the proposed new airport.

“First, we are conducting a study on whether there is a need for the airport, we are talking about 30 years from now,” he said.

As for Kedah’s proposed Kulim airport, Chow said the Kedah Mentri Besar has mentioned that it will be a cargo airport.

He said a lot of studies will still need to be done on whether there is a need for a cargo airport in Kulim.

“I will leave it to them to conduct the studies so it is still very early to be talking about the airport,” he said.

When asked about the pending approvals for PSR and PTMP, Chow said he had brought both projects up in Putrajaya when he was there for meetings last week and early this week.

“With regards to the LRT, the person from APAD wanted us to get the PSR presented to the National Physical Planning Council and also to submit the EIA report,” he said.

APAD is the Land Public Transport Commission.

Chow said the state had already submitted the environmental impact assessment (EIA) but they had to improve on it based on feedback from various committees.

“So APAD said if we can finalise it, the LRT approval will be forthcoming,” he said.

The light rail transit (LRT) line, connecting Bayan Lepas to George Town, is one of the projects proposed under the PTMP including the controversial Pan Island Link 1(PIL1).

Chow said he had asked the transport ministry to give the state conditional approval for the LRT project so that the state can start working on complying with other requirements.

“Or we can get our PSR approved first. In the earlier days, we were told to get our LRT scheme approved first but at this rate, nothing will move,” he said.

The Penang state government is hoping to get the LRT conditional approval once it tables its presentation on the PTMP and PSR to the National Physical Planning Council in April.

Source: MalayMail.com

The Malaysian Institute of Estate Agents (MIEA) has urged the government to extend the incentives offered during the Home Ownership Campaign (HOC) to first-time home buyers looking to buy from the secondary market.

The Malaysian Institute of Estate Agents (MIEA) has urged the government to extend the incentives offered during the Home Ownership Campaign (HOC) to first-time home buyers looking to buy from the secondary market. Penang state government will turn some of its low cost housing units into rent-to-own schemes and offer it to those who applied for people’s housing project (PPR) units.

Penang state government will turn some of its low cost housing units into rent-to-own schemes and offer it to those who applied for people’s housing project (PPR) units. For most Malaysians, buying a house is tough. A high upfront payment coupled with a life-long mortgage commitment can be daunting, so it makes sense to take any help you can get to lower the cost of owning a home. Besides the many freebies and promotional packages that property developers are offering, the government has come up with several incentives to assist the rakyat, especially the lower income group and first-time homebuyers, such as stamp duty exemptions, deposit assistance and low-interest rate loans. Here are some of them.

For most Malaysians, buying a house is tough. A high upfront payment coupled with a life-long mortgage commitment can be daunting, so it makes sense to take any help you can get to lower the cost of owning a home. Besides the many freebies and promotional packages that property developers are offering, the government has come up with several incentives to assist the rakyat, especially the lower income group and first-time homebuyers, such as stamp duty exemptions, deposit assistance and low-interest rate loans. Here are some of them.