SkyWorld – Setting New Benchmarks in Urban and Affordable Housing

Founded on a single, unwavering vision – “Always Best City Developer” – and guided by its purpose to “Make Living Better”, SkyWorld Development Berhad (“SkyWorld”) is a forward-thinking urban property developer dedicated to shaping inclusive, well-designed city communities. Since its inception, SkyWorld has built a strong reputation for delivering innovative developments underpinned by quality craftsmanship, thoughtful planning, and a deep understanding of urban lifestyles.

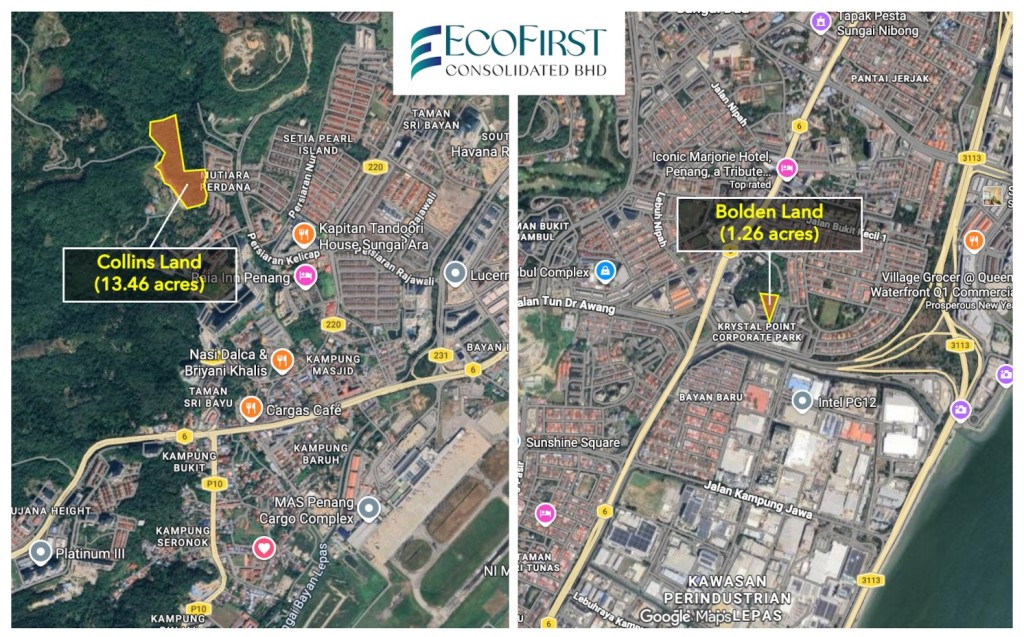

SkyWorld’s core focus lies in the development of high-rise residential, commercial, and affordable housing projects that respond to the evolving needs of modern city dwellers. Its ongoing and planned developments are strategically located within key urban growth corridors in Federal Territory of Kuala Lumpur and Penang, ensuring strong connectivity, accessibility, and long-term value for homeowners and investors alike. Each project is carefully curated to integrate functionality, liveability, and sustainability, reinforcing SkyWorld’s commitment to creating holistic urban environments rather than standalone buildings.

A defining pillar of SkyWorld’s success is its leadership in affordable urban housing, a segment often challenged by rising costs and limited land availability in city centres. SkyWorld has consistently demonstrated that affordability does not have to come at the expense of quality, design, or liveability. This commitment is most notably reflected in its developments in Penang, where SkyWorld is recognised for undertaking the largest affordable housing projects in the state. These developments play a meaningful role in addressing urban housing needs, providing well-designed homes that are accessible to a wider segment of society while contributing positively to the surrounding communities.

International Recognition and Awards

SkyWorld’s commitment to design quality, construction excellence, and community impact has been acknowledged on the global stage through the FIABCI World Prix d’Excellence Awards — widely regarded as the “Oscars of Real Estate.” Organised by the International Real Estate Federation (FIABCI), these awards celebrate outstanding real estate developments that exhibit excellence in architecture, innovation, sustainability, and social value.

Over recent years, SkyWorld has garnered multiple world-level FIABCI accolades:

- SkyAwani 2 Residences — Gold Award in the Affordable Housing category at the FIABCI World Prix d’Excellence Awards 2023.

- SkyAwani 3 Residences — Gold Award in the Affordable Housing category at the FIABCI World Prix d’Excellence Awards 2024.

- SkyLuxe On The Park Residences — World Silver Award in the Residential High-Rise category at the FIABCI World Prix d’Excellence Awards 2025, marking SkyWorld’s first global recognition beyond the affordable housing segment.

These consecutive wins illustrate SkyWorld’s ability to deliver developments that excel both in community-oriented housing and in higher-end residential segments, reinforcing its leadership on the international stage.

Quality Benchmarking with QLASSIC

A cornerstone of SkyWorld’s development philosophy is construction quality, measured objectively through QLASSIC (Quality Assessment System in Construction) — Malaysia’s national standard for assessing workmanship quality in completed building projects, administered by the Construction Industry Development Board (CIDB). QLASSIC evaluates structural works, architectural finishes, mechanical and electrical installations, and external works against industry benchmarks.

SkyWorld has achieved notable QLASSIC performance across several developments, reflecting rigorous quality control and adherence to high construction standards:

- EdgeWood Residences at SkySanctuary, Setapak achieved a high QLASSIC score of 86%, demonstrating superior workmanship and quality execution in line with CIDB standards.

- SkyAwani 5 Residence, part of SkyWorld’s affordable housing series in Sentul, achieved an 84% QLASSIC score, which is recognised as the highest QLASSIC score recorded for an affordable housing development — a significant milestone within this housing segment.

These high scores underscore SkyWorld’s discipline in delivering homes that are not only well designed but also built with craftsmanship and durability that surpass industry averages.

Staying true to its brand promise, “YOU CAN NOW OWN A QUALITY HOME AND LIVING,” SkyWorld continues to advance its mission of making quality housing accessible and meaningful, nurturing communities that thrive in today’s dynamic urban landscape.

For more information, please visit www.skyworld.my.

Register your interest here in Skyworld’s first project in Penang – Skyworld Pearlmont